Private Networks for Mining

An overview of the challenges, market drivers, use cases and trends for private networks for mining.

by Dean Bubley of Disruptive Analysis

Introduction

Want to learn more about private networks for the mining industry? Download our latest eBook, Private Networks for Mining, written by industry thought-leader Dean Bubley of Disruptive Analysis.

Mining is a huge and important sector. It generates around $2 trillion in revenues globally, employing perhaps 20 million people across 50-100,000 sites around the world. The industry is now becoming even more network-dependent, but it also has some of the most demanding requirements for communications networks of any industry vertical.

This eBook outlines the challenges, market drivers, use cases and trends for private networks for mining.

Summary

Mining is a huge and important sector. It generates around $2 trillion in revenues globally, employing perhaps 20 million people across 50-100,000 sites around the world. While some parts of the industry are dominated by giant multi-national mining companies, other minerals tend to be more localised and involve smaller, national firms.

Mining operations are typically conducted in harsh environments, across large sites, both above and below ground. They may have multiple risk factors, dynamic and often “unplannable” working environments, and high levels of mechanisation – and, increasingly, automation. Prices of minerals can fluctuate hugely, while supply chain frictions have multiplied in recent years. As a result, industry economics, planning and profitability has become less predictable.

As a result, the mining sector has some of the most demanding requirements for communications networks of any industry vertical. It operates safety-critical infrastructure, heavy machinery and numerous vehicles over vast areas, often in extremely remote areas – both above-ground in pits, and in underground tunnel environments. The terrain and operational area changes size and shape, which makes permanent wiring another challenge. Some sites also have to deal with extra concerns such as flammable gases and explosive blasting. In developed countries at least, regulatory oversight is stringent.

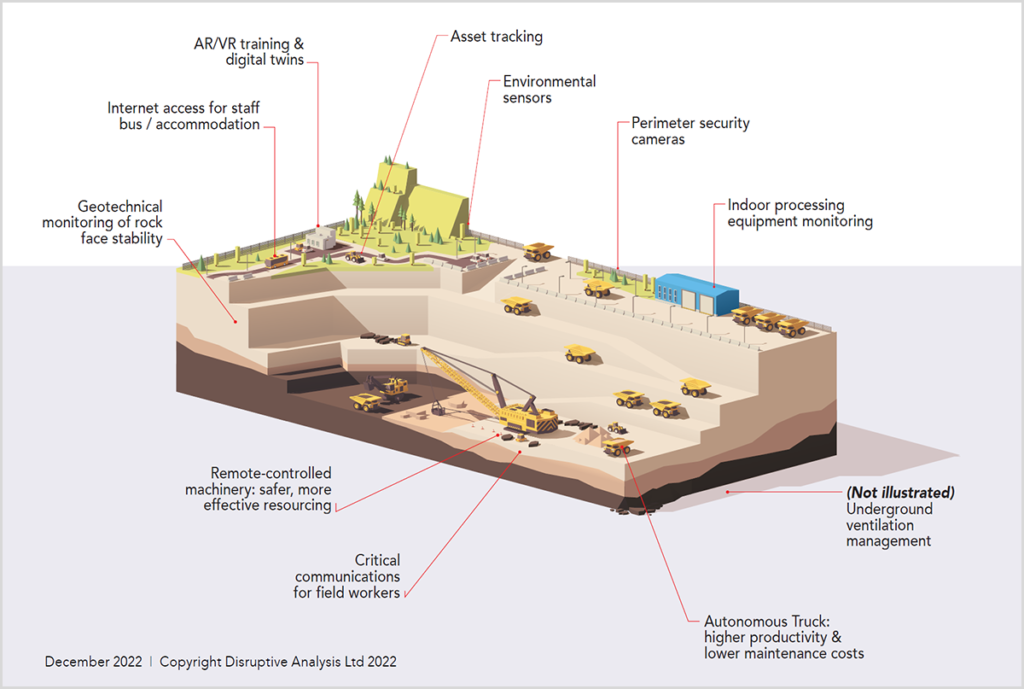

The industry is now becoming even more network-dependent. With the advent of “smart mining”, the industry is further adopting automation, environmental sensing, worker-safety and training systems, plus a wide variety of asset and productivity management tools. These all require more data, enhanced networks and greater oversight and security.

This eBook focuses on emerging trends in private networks – and especially the use of cellular (3GPP) wireless technologies such as 4G/LTE and 5G. Mining has been one of the most important early sectors for deployment of enterprise-focused mobile networks for some time, with fairly widespread use of Private 4G since for 6+ years, and ongoing adoption of 5G. Some early adopters even had local 2G or 3G networks before 2010.

There are currently perhaps 100-200 mines with private cellular networks in operation, although hard data is hard to compile as many deployments are not publicised. Most of these are 4G, although interest in 5G is rapidly increasing, with various pilots and trials ongoing.

That said, mining is a very network-diverse sector. As well as 4G/5G, trunked radio systems are used for personal communications with technologies such as TETRA and P25, there is significant adoption of mesh wireless for IoT, Wi‑Fi is used for enterprise applications and wide-area satellite links have been used extensively. Some industrial systems have proprietary wireless connectivity. Fibre is deployed where it can be safely (and permanently) installed.

Over time, some of these use cases may migrate to 4G/5G, while other new examples will doubtless emerge for the other technologies. They are also evolving – for instance Wi‑Fi evolution to 6/6E/7, which may alter the decisions taken by network administrators and purchasers.

The global nature of the mining industry means that regulatory factors are highly site-specific (or country-specific) – often involving policymakers who may not be on the forefront of trends in networks or spectrum. This means that mines are likely to have network choices made partly on the basis of local factors.

Table: Examples of Mining company private 4G/5G deployments/trials

| Company / Location | Country | Sector / Purpose | Spectrum / Technology | *Vendors / SPs |

|---|---|---|---|---|

| Antofagasta | Chile | Autonomous trucks & other apps | 4G – band unclear | Nokia |

| Agnico Eagle | Canada | Push-to-talk, IoT, vehicles, location | LTE + NBIoT 850MHz | Ericsson, Ambra |

| Newcrest Mining | Papua NG | Remote machinery operation | LTE, dual frequencies | Telstra Mining |

| South32 | Australia | Vehicles, IoT, employee safety | LTE | Telstra, Ericsson |

| Boliden | Sweden | Remote machinery & vehicles | 4G + 5G upgrade path | Telstra, Ericsson |

| Gold Fields Aust | Australia | Critical voice, SCADA, staff Internet access | LTE in 1800MHz | Challenge Ntwks, Nokia, Cisco |

| Zinkgruvan | Sweden | Critical comms, remote machines, Positioning of staff & assets | LTE + BLE beacons, 5G upgrade path | Athonet, Telia, Mobilaris |

| VALE | Brazil | Multiple mines, autonomous & remote vehicles, geotechnical sensors, worker safety | 4G LTE in 2100MHz + testing 5G. Also public 4G for local community | Vivo Brasil + Telefonica Tech + Nokia |

| Minera las Bambas | Peru | Critical comms, safety solutions, automation | Private LTE | Nokia, Telefonica |

| Norilsk Nickel | Russia | Autonomous mining, remote control, critical voice, robotics | Private LTE + testing 5G | Nokia, SPBEK, Qualcomm, Tele2 |

| CODELCO | Chile | Video camera from crusher (test) | 5G testbed | Nokia |

| Gold Fields | Chile | Remote trucks & machines, drones, sensors | Private LTE | Nokia, Claro |

| NORCAT | Canada | Mine training & test centre – uses wireless for innovation, learning | Private LTE, 5G upgrade planned | Nokia, CENGN, Ericsson |

| Sandvik | Finland | Test mine for prototyping multiple smart mining systems, e.g. remote control, 4K video, etc | 5G standalone | Nokia |

| Taiyuan Mining Innovation Lab | China | Innovation site for testing / developing smart mining solutions | Various 4G/5G systems | Huawei |

Source: Disruptive Analysis

*May also feature other vendors

Definition of the sector

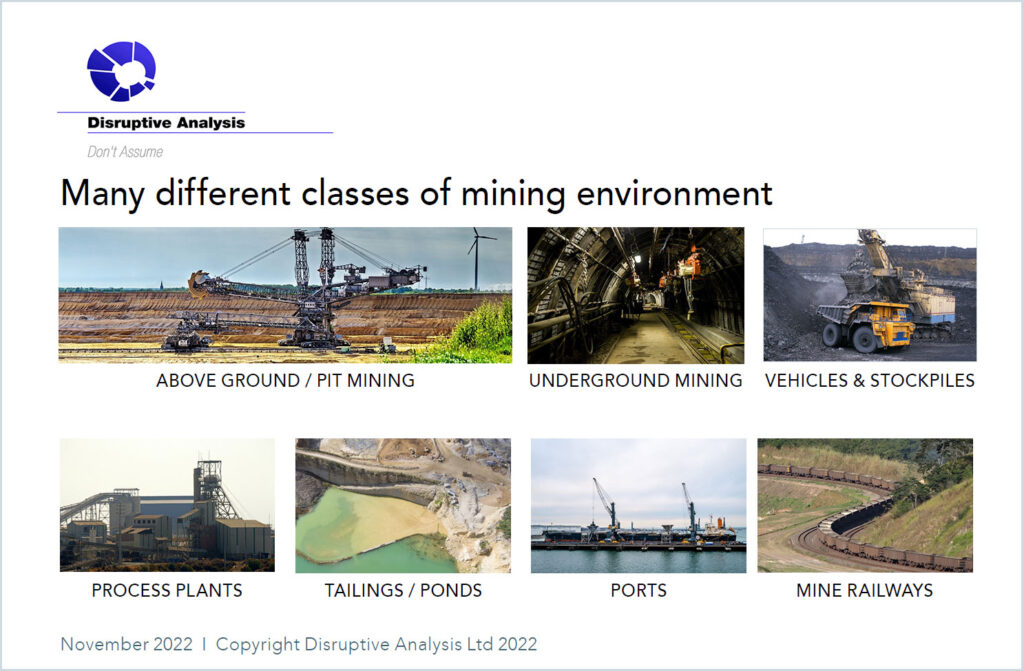

There are numerous sub-sectors and site types covered in this report. The mining industry is quite diverse in terms of physical environments requiring connectivity, as well as overlapping with other sectors such as transportation and energy (covered in previous iBwave eBooks).

The key domains requiring wireless networks include:

Any given mine may have multiple zones corresponding to these categories. These may be closely located to each other – and thus perhaps covered by a single network infrastructure – or could be spread out over many kilometers, or perhaps greater distances still where there is a railroad to a port or processing unit.

Taken together with the multiple use cases described later in this eBook, it should be apparent that private wireless has many opportunities in mining – but these will often need good understanding of the sector, as well as partnership and collaboration between suppliers, service providers and specialist integrators and installers.

Key trends, challenges and market drivers

The mining industry faces a broad set of underlying trends and transformation drivers, shifting it towards connectivity and especially private wireless networks. Some, such as macroeconomic unpredictability, are external and common across multiple industries, while others such as decarbonisation and safety have very specific impacts for mining.

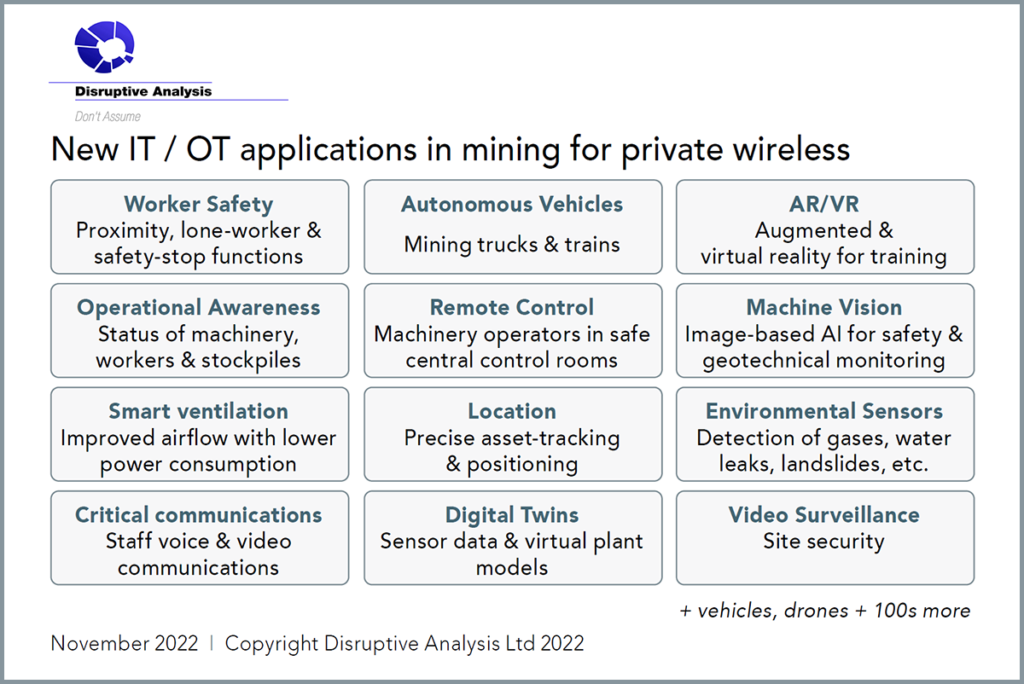

Various terms such as “Connected Mining” or “Smart Mining” are used to describe the transformation and adoption of new classes of IT / OT (information and operational technology) and the networks that support them.

Broadly speaking, all these trends create a greater requirement for connectivity, control and information flows. In addition, none exist in isolation – many are interlinked, and will require a holistic network fabric extending across the entire site and beyond. Combined, all of these broad factors, as well as company- or country-specific trends mean that networks need to be:

Historically, many mines have had technology “silos” with separate communications tools and networks. Wireless networks have been very important, given the large areas and mobility involved, but have practical challenges because of shifting topography and radio propagation challenges. Mesh systems, either based on Wi‑Fi or similar 802.11 technologies, have often been used, but have constraints, especially for vehicular coverage or extended tunnel networks.

Thus while mining companies will still frequently use traditional forms of connectivity – notably fibre for critical assets or Wi‑Fi for office-based locations – there will be a growing demand for cellular connections, using either 4G or 5G technologies. Often multiple technologies will be used in combination, such as satellite backhaul for remote sites’ local wireless connections, or Wi‑Fi gateways connected via 5G.

Key use cases for private wireless networks in mining

Given the industry structure and changes outlined above, there are two layers of questions to address in this report:

This section highlights some of the emerging use cases that can benefit from cellular connectivity. While there are likely hundreds of applications overall – and some such as general office IT are omitted for conciseness – the following are typical of the aspirations of many companies in these sectors.

Remote Control of Drilling, Excavation & Other Equipment

The central function of mines is the extraction of rocks, ores and minerals. This requires a broad range of drills, shearers, excavators, tunnel-boring machines, conveyors, lifts and their associated controls. These work both on surface pits and underground. A large mine can have hundreds of machines of varying size and function.

An increasing number of machines and items of equipment are connected for remote control or autonomous operation. It may be possible for workers to be located in centralised control rooms, rather than needing to travel to the cutting site – which could be deep underground and along miles of tunnel. This is both safer and more efficient – the same specialised worker could remotely conduct operations in many places on the same shift, rather than needing to shuttle between them.

This requires cameras, telemetry and monitoring systems, as well as data collection and analytic platforms. There may be collaboration between groups of machines and operators. There are stringent safety controls, especially where personnel are present in the same location as automated machines. While some can use fixed/fibre connections, the nature of mine sites means that equipment moves frequently – so using wireless improves efficiency and minimises downtime for re-wiring.

Mine operation centres need excellent centralised control and visibility of systems and machines to ensure safe operation, optimise productivity and deal rapidly with unexpected events or emergencies. In future, remote operators may use augmented-reality screens or headsets, while AI-type systems may optimise vehicle routing for lower energy consumption or alter the dig pattern to improve yields.

Remote and wireless controls require high bandwidth for video-cameras and associated data streams, with low-latency to minimise lags. In some cases, edge-computing functions may be used optimise actions taken at the drill-face or by vehicles. Other operational items such as rock-bolts may be made “smart” with wireless sensors to warn against imminent risks of collapse.

Safety-Critical Communications

Personal communication is essential for safe and productive mining operations, especially in remote, dangerous and underground environments. There is a great need for push-to-talk (PTT), industrial phones in fixed locations, alerting systems and ever more video-based communications. Because the nature of mining operations, with complex physical topography, such systems need to work inside tunnels and pits, around piles of rocks, as well as inside machines and vehicles with heavy metalwork. Local (on-site) connectivity and call-control is essential, as many mines are in remote areas with no reliable connection to public mobile networks.

Under normal situations, workers will use mission-critical PTT and PTV (push to video) to determine actions, problems and coordinate teams. Operators and dispatchers must also react promptly to emergencies and identify potential problems. The nature of crisis management means that protecting workers puts a premium on reliable voice and messaging systems. In a dangerous situation, miners (or automated devices) can send alerting messages or calls to the control centre. These can also track realtime health telemetry data such as heart-rate or blood pressure.

Historically, such as PTT systems have typically been reliant on older networks such as “trunked radio” (or PMR – private mobile radio) and standards such as TETRA and P25. While highly reliable, these have limited capabilities beyond voice and can be expensive. Cellular handhelds can combine PTT with a variety of data applications and video.

Most cellular MC-PTT systems are currently optimised for 4G LTE networks but are being updated for 5G. In addition, there may also be a need to inter-operate with the normal telephony networks as well, for instance for business interactions between mine sites and HQ offices, as well as contractors, transportation companies and other suppliers.

Oversight and automation of haulage, loading and train operations

Mines have huge transportation requirements, both on-site and for outbound shipping. Depending on the size and structure of the site, some can use belts for moving ore from the mining-face directly to processing, stockpiles or loading zones. However, many others need huge trucks or other vehicles.

Transportation of ore or part-processed minerals from the mine’s location to ports, further processing plants or supply-chain locations is a central element of the industry. Efficient and safe systems to load trucks, train cargo wagons or ships is a major focus of site infrastructure operations. This links to further requirements to automate and optimise stockpiles and other storage space on-site.

In recent years there has been significant investment and innovation in automation of mine transport systems. This includes both fully-autonomous and remote-controlled operations. Typical haulage roads and dedicated train-tracks are simpler than the public road/rail networks and subject to different regulatory controls and safety regimes. This means fewer variables for an automated system – and earlier adoption of self-driving machinery.

This requires extensive real-time monitoring and reliable connectivity. There are needs for telemetry from the automated systems and video surveillance of operations. Record-keeping is often mandated, requiring large volumes of data to be transmitted and stored. High-precision location is used for asset-tracking and positioning of load/unload systems. Motors and vehicle sub-systems may be monitored for preventative maintenance, or to optimise aspects such as tire-wear and fuel consumption.

There is also a very high requirement for mechanisms for detecting humans too close to automated machines – and to stop operations if needed. While these may use on-vehicle cameras and analytics software, it is likely that the data will also be stored for later offload or streamed as well.

For all of these capabilities there needs to be broad, reliable and continuous network coverage, with adequate capacity and speed. There may also be very different network requirements for mine trucks navigating an open pit, compared to a special railway or bulk shipping port, while trucks may need to work on public networks away from the mine, if they travel on normal roads.

Asset tracking, positioning & geofencing

Both in pits and underground mines, monitoring positions of equipment, vehicles and personnel in realtime is hugely important. There are clear safety implications where huge vehicles (perhaps driven autonomously) and robotic drills share space with human workers. Additional location-specific risks relate to explosives, noxious gases and other hazards. Ideally, “geofences” can be set up, providing virtual safety-zones that can stop machinery or blasting detonations, if someone gets too close – or to warn about poor air quality, when linked to sensor networks. However, GPS signals do not work underground, or in the shadows of deeper pits.

Underground geolocation is especially hard, but allows mining operations to be fully transparent, maintaining data on everyone and everything. As well as realtime tracking, collection of time-series data can feed into analytics systems to help optimise mining operations.

Private LTE/5G (and also Wi‑Fi) can allow accurate localisation of people and assets via tags, handhelds, wearables or integral modems in other systems, linked to a 3D map of the mine and its associated radio network.

Realtime operational awareness

Mines are increasingly reliant on IoT systems and large-scale data collection and analytics. This is necessary for operational optimisation (at multiple stages from exploration to mining to processing) and to ensure environmental responsibility and miner safety.

Data is collected from a vast range of sources, from machine performance (including vibration/temperature) to worker health and fatigue (e.g. heart-rate and motion sensors). These can feed into preventative maintenance actions, or pre-emptive workforce rostering decisions. Video inputs and climate-monitoring systems can enable rapid identification of emergencies and appropriate responses.

As well as fixed sites, data or video is also collected from wireless sensors on vehicles, humans or robots. Cameras or other devices may not be located in fixed places but could move on rails or even drones. Given large physical areas of mining operations, Wi‑Fi may not be suitable, compared to 4G/5G cellular. Given the growing data-volumes and aspirations for realtime analysis, 5G low-latency capabilities will become more important over time.

More broadly, mining companies also need access to external data and integrated systems, for instance commodity prices, weather forecasts and transport / supply-chain management platforms for the wider enterprise.

Taken together, operational intelligence and situational awareness allows for better asset-utilisation and resource-allocation.

Smart ventilation

Safe underground operations rely on extremely reliable and high-performance ventilation, providing air to miners, venting waste gases and potentially reacting to toxic chemicals. Smart ventilation enables fans and regulators to be controlled efficiently, with sensors monitoring air-quality and pressure. Realtime control ensures safe air for workers, while improving efficiency and optimising energy consumption by the fans. An additional benefit is that this means existing ventilation infrastructure can cope with expansion of mining tunnels, without adding extra capacity.

Private LTE or 5G enables more flexibility in the location of sensors compared to fixed wiring, especially using LTE-M or NB-IoT for wide-area coverage with lower power consumption / longer battery life.

Water management

Water management is essential for operational requirements such as equipment cooling and dust-control. Monitoring seepage, rainfall accumulation, waste-water flows, and possible contamination of the mine’s local environment is also important. Many mines are in remote or arid areas, with a huge need for efficient at reuse of water resources.

Private networks have roles to play in both connecting pumps and systems consuming water in the mine itself, and also for monitoring pipelines or local water bodies for turbidity, algae, chemicals or fish/vegetation health. Terrestrial sensors and wireless connectivity may be supplemented with drone-based or satellite imagery.

Video surveillance

There is a growing range of use cases for video monitoring in mining. Surveillance is used for mining operations, perimeter security, theft-prevention, fire and smoke detection (especially by thermal cameras) and situational awareness of personnel and vehicles. Increasingly, video analytics can feed directly into automated systems and rapid decision-chains on-site. Wireless connectivity can enable real-time, high-definition streaming across wide areas both on the surface and underground.

In some cases, cameras could be mounted on tracks or rails, or small mobile robots, for periodic inspections across multiple tunnels or areas of interest.

Realtime video is also used to monitor the geotechnical safety of stockpiles and mine-tailings – the waste material often collected in piles or pools on the site. There have been dangerous instances arising from dam collapses, landslides or other breaches.

There is also a requirement for long-term video surveillance after a mine has closed or has been mothballed. Thermal cameras can provide intrusion protection and also limit costs from investigating false alarms in remote areas. Underground tunnels and mineshafts can also be monitored with for collapses and other risks.

Wireless VR-based training and assistance

The mining industry can be one of the most dangerous occupations for workers. Immersive AR and VR-based training can yield significant advances in occupational health and safety training, especially for new hires. Miners and vehicle operators can acquire and practice effective behaviour in a controlled, safe environment – either onsite at the mine site, or at a dedicated training facility. VR training environments can be collaborative, with peers or more experienced personnel working “alongside” trainees.

An example of a training scenario could involve setting and detonating explosives for blasting works – a dangerous operation especially underground, because of methane gases and the risks of tunnel collapse. VR training can enable practice for this type of complex, multi-task operation, linked to digital twins or 3D maps of the mine.

As well as training situations, AR tools may also be useful for operational tasks such as equipment maintenance, vehicle loading or site construction. Use of special glasses, or just superimposed tags on a tablet screen, can improve efficiency or allow hands-free operation of machinery and tools. Underground workers could also use “smart helmets” with AR capabilities to communicate with above-ground colleagues, for instance for remote technical assistance.

Connected AR/VR devices may use either cellular or Wi‑Fi connections. In general, outdoor and “in-field” use are more likely to be 4G or ideally 5G for lowest latency and coverage. Use in classroom or other indoor settings is more likely to rely on Wi‑Fi. Low latencies are especially important to reduce the risk of “VR sickness” that affects some people using immersive technology. Haptic controls which give touch/force feedback can improve the realism of the experience, but also need very fast response times.

Private vs. public wireless networks

Private and local cellular networks are helping mines’ connectivity evolve. Initially these have mostly been built with 4G technologies, but now increasingly 5G deployments and use cases are becoming more practical and desirable, with lower latencies and higher network capacities.

There are various approaches to building cellular networks at mining sites:

Given the remote sites of most mines, there is a limited role for MNOs using their “normal” national macro 4G/5G coverage, although their existing networks may work for certain operations such as telematics for trucks, or telephony and Internet access for above-ground workers, or accommodation in nearby communities.

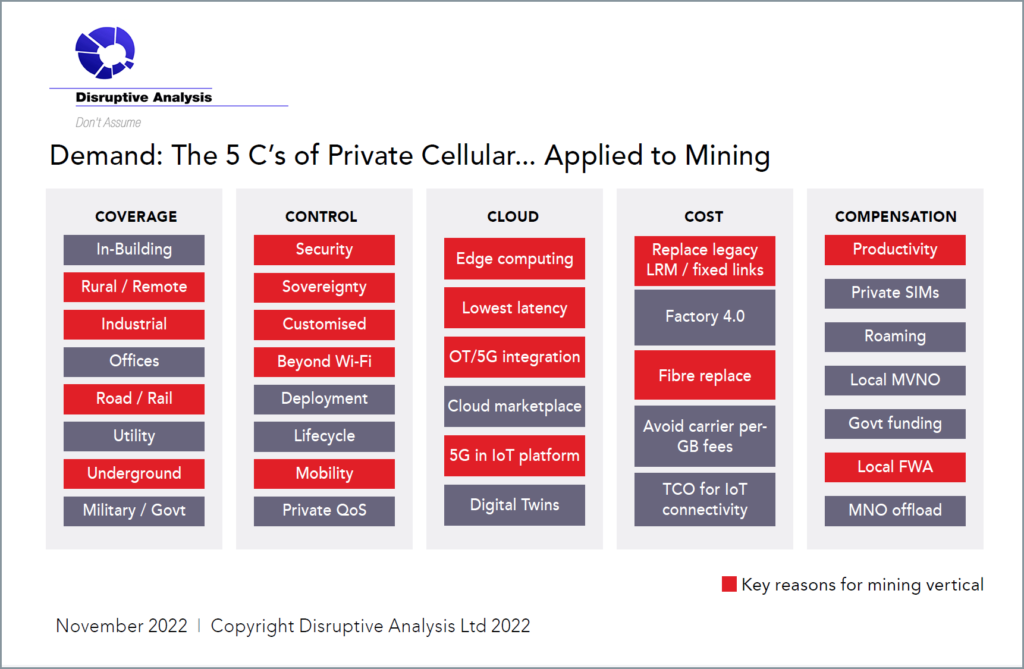

While coverage issues tend to dominate here, it is not the only rationale for private cellular. Looking across different industries, there are many other company- and application-specific reasons that drive firms to look at dedicated wireless solutions.

There are five top-level rationales:

The following sections describe these in greater detail.

Coverage

The core reason for using private 4G/5G rather than public MNO services is the limitations of network coverage. MNOs tend to deploy network assets in areas with high population density, or along main roads.

As mines are often located in remote regions, where national MNOs (mobile network operators) often have poor macro-cellular coverage, dedicated systems are commonplace. Many important mine-sites are also located in countries or regions that have not yet deployed 5G, or even good-quality 4G networks.

Underground tunnels obviously need customised, local wireless connectivity. Deep pits also represent significant challenges for propagation, with local small cells or radio heads required to deal with shadowing effects. The nature of mining means that site topography may change over time, with large amounts of rocks being moved, or metal structures being deployed. Blasting operations may mean that network infrastructure might need to be moved temporarily. Drones used for observation may need aerial wireless coverage at significant altitude. Dedicated roads, private rail-tracks and port facilities are likely to be outside most MNOs’ normal planning and deployment priorities.

Taken together, mining represents a unique set of challenges for coverage, which push the industry towards creating dedicated systems rather than relying on public network provision.

Control

Owning, specifying and/or operating private wireless allows mining companies to define and optimise many network parameters themselves, taking direct responsibility for security, reliability, performance and reporting.

They can choose their own mechanisms for redundancy and cybersecurity, aligning with sector-specific best practices and regulations, or the requirements of vehicles and specific analytical compute functions. For demanding applications like streaming video or low-latency remote-control of machinery, they can customise and optimise radio resource management and redundancy.

For instance, high-definition cameras need more uplink capacity than may be available on public networks, especially in TDD (time-division duplex) spectrum bands primarily intended for consumer usage of streaming media and downloads.

Increasingly, mines need higher-performance networks than in the past – whether those were delivered with Wi‑Fi or various proprietary systems. Autonomous and remote-controlled vehicles need full support of mobility without drops or pauses between wireless nodes. Latency is increasingly a focus, given automation of realtime processes and time-sensitive operations.

Private cellular also allows for local control and security measures to be enacted, by use of on-site core network elements.

Cost

Generally speaking, the costs of wireless networks for mines is a comparatively small proportion of overall site expenditure on capex and opex. There may be some pricing advantages of private 4G/5G compared to older radio systems or microwave links, but the real benefits may come from the ability to connect more endpoints – whether those are IoT sensors, modules for vehicles and machinery, or higher-specification handhelds for workers which can support data and productivity applications.

In some cases there may be some more hard savings compared to public MNO services, or perhaps in reducing some use of satellite connections.

Cloud

In the wider enterprise marketplace, there is a growing link between enterprise private wireless and cloud platforms, as many software elements such as network cores are delivered via virtualisation and containers, rather than physical appliances. Mining companies are also increasingly using cloud-based IoT or AI platforms, perhaps delivered via edge-computing capabilities.

There are significant synergies between cloud infrastructure and private wireless, for instance where an on-site node can support the core network function for private 5G, as well compute.

More broadly, cloud-based solutions used for running and optimising operations – or perhaps enabling preventative maintenance or enhancing workers safety – use far more data, from many more sensors, machinery, cameras and input sources. This inherently needs networks with better coverage and much greater capacity – as well as support of mobile end-points such as vehicles or wearables.

Compensation / Monetisation

While some sectors use private networks as a potential source of revenue, for instance from 3rd party tenants onsite, that is less true of the mining industry. In some cases there may be external users from contractors, or perhaps independent processing companies and others sharing the same site and wireless systems, but it seems unlikely that many mining firms will directly monetise their networks.

The main financial incentives for private 4G/5G will come from enhancements to productivity, better asset management and resource-allocation, and perhaps lower downtime.

There is also an opportunity for mining system suppliers to leverage private networks – for instance, truck supplier Scania uses vehicle connectivity as a basis for subscription-based services such as its “site optimisation” toolset.

One other angle to consider is that of the government that licenses the mining sites and operations. In some cases, mining represents a sizeable contribution to national income and employment, both through license fees and additional taxes and royalties. This may incentivise the regulatory authorities to issue specific spectrum to mining firms for wireless networks, as they see the opportunity for additional economic benefits elsewhere.

SELECTED PRIVATE 4G/5G USE CASES AT A MINE SITE

Network deployment decisions and practical considerations

This section considers a number of practical and technical issues relating to deploying private wireless networks in mines:

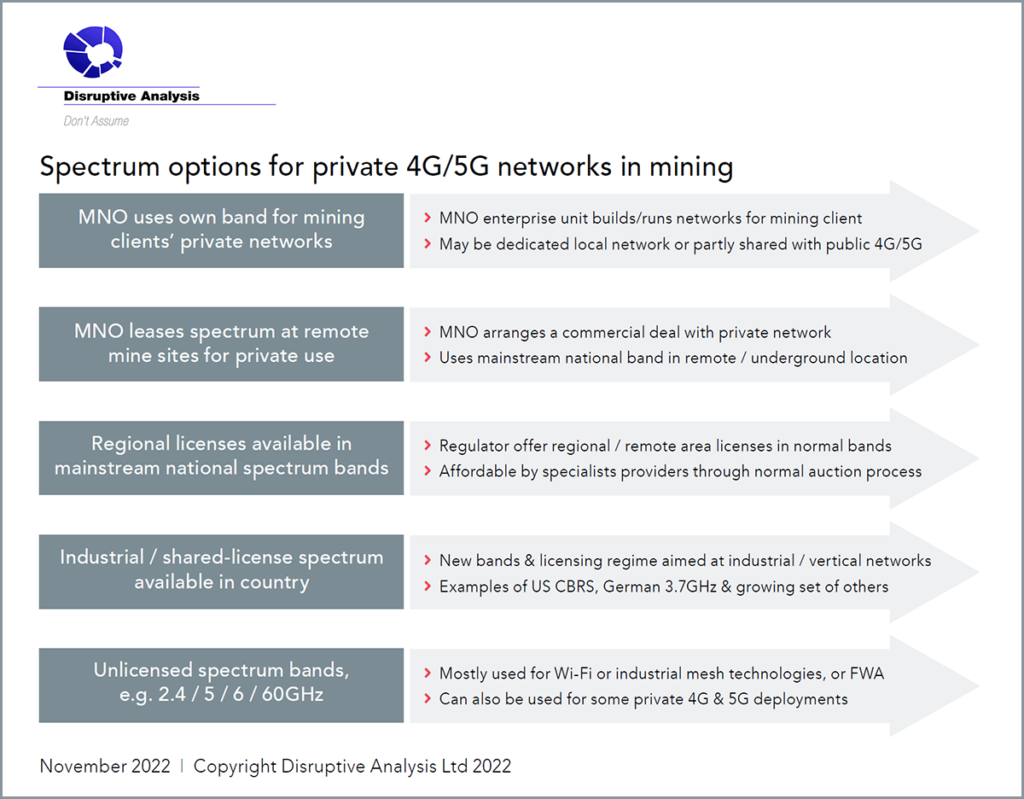

Spectrum

A key ingredient for mine sites’ private networks is access to suitable spectrum for 4G/5G. This introduces a huge range of trade-offs in terms of coverage, capacity, cost, device availability – and also politics and regulation.

For wide-area coverage, sub-1GHz bands have the best range for private wireless, especially for supporting critical communications capability for voice and basic data / control systems or broad IoT networks.

Mid-band spectrum between 2-6GHz is generally optimal for mid-size private networks such as specific sites up to 10km scale, but can also be extended for broadband along roads, rail-tracks or pipelines.

Although higher mmWave bands are widely discussed for 5G, they have poor propagation and generally very short range, although capacity is huge. For mining they currently have very limited applicability, although potentially could be used in processing plants or for specific underground applications.

Historically most spectrum suitable for cellular networks has been awarded on an exclusive regional/national basis to public mobile operators (MNOs), often through auctions procedures.

Mining companies have typically used different (non-cellular) bands for their fixed wireless links in specific locations. For critical communications, LMR/PMR systems have used low-frequency, low-capacity bands suitable for push-to-talk and little more.

In some cases, industrial-focused network operators have been able to acquire tranches of spectrum suitable for private networks, especially in countries that auction regional licences, such as Canada, Australia or in Norway’s offshore economic zone. This has been used for mining and oil/gas connectivity by various providers.

Mining companies have sometimes been able to obtain special licenses for remote areas, by negotiating with MNOs or regulators, or where governments have decided they constitute important national priorities. For underground mines, there is obviously no risk of interference with the macro networks, so operators’ spectrum departments tend to be more accommodating if there is a financial gain to be made.

However, these arrangements are the exceptions. Historically, most enterprises, or specialist systems integrators, have had little direct access to such mainstream mobile bands, while few devices have supported more unusual frequency options that might have been available.

This situation is now changing significantly across much of the world, as more bands are being made available, while 4G and 5G device and network equipment support for multiple bands is more common. A growing number of countries are making sections of mid-band spectrum available for mining companies (as well as other enterprises). Typically this is based on some form of spectrum-sharing, with either manual or database-driven licensing for specific areas and band rights. The best-known schemes are those in the US (CBRS), Japan, Germany and the UK, but many other countries are exploring similar options (for instance Saudi Arabia and Canada).

There is also growing interest by some mainstream MNOs in setting up specialist mining business units or competency centres. These typically build networks using their nationally-licensed spectrum, but with bands that are often left unused in remote regions – for instance Telefonica’s Vivo arm using its 2.1GHz allocation in Brazil.

Some examples of local spectrum accessible for the industry include:

Table: Examples of Transport / Logistics private 4G/5G deployments/trials

| Country | Spectrum bands | Licensing model |

|---|---|---|

| US | 3.55-3.7GHz | Tiered licensing & dynamic access via automated SAS (Spectrum Access System) providers. Priority Access Licenses were auctioned on a county level basis. General Authorised Access is widely usable. |

| Germany | 3.7-3.8GHz | Reserved for localised private network licensing, either with 4G or 5G equipment. Licensees can request rights for specific locations from the national regulator – typically for campus-sized facilities. |

| France | 2.6GHz 3.8-4.2GHz | 40MHz section of the 2.6GHz band has been made available for critical communications and industrial broadband use. New use of local licenses in Ban 77 is evolving & may be extended. |

| UK | 3.8-4.2GHz 1.8GHz 2.3GHz | The 3.8-4.2GHz band is available for local 5G use, subject to protecting incumbent licensees. There are also small allocations at 1.8GHz and 2.3GHz. Another class of licenses is available for agreed secondary re-use of existing MNO bands in specific locations where they are unused. |

| Japan | 4.6-4.9GHz | Local 5G licenses |

| Australia | 1.8GHz | 30MHz set aside for enterprise & community groups |

| Finland | 2.3GHz 26GHz | Local licenses for industrial networks & other use cases |

| Chile | 2.6GHz | Local networks widely used for mining. Also, participation of MNOs allows use of national licensed bands. |

| Denmark | 3.7GHz | Leasing from MNOs is possible, albeit rare. |

| Canada | Various bands possible or under consultation | Remote areas have industrial SPs with various licenses around 700-950MHz, but Canada also considering CBRS-type models. |

| Taiwan | 4.8GHz | |

| China | Various bands with MNO or government permission | Common participation of China Mobile and other MNOs in industrial projects, with government support on spectrum availability. |

Source: Disruptive Analysis

It is also worth noting the potential for using unlicensed bands at 2.4GHz, 5GHz and increasingly 6GHz as well for private 4G/5G – although the lack of interference protection may limit the scope for mission-critical applications.

Planning and design considerations

Private networks in mining environments are often very different to those installed in more predictable locations such as factories, ports or warehouses. This means that planning and design is a highly specialised and site-specific task, especially where new technologies such as 5G are being tested or deployed.

Some of the considerations that integrators and service provider staff need to deal with include:

Network diversity

While private 4G/5G is clearly becoming more important in mining, sites will remain highly “diverse” in terms of network technologies deployed and used. A typical site may incorporate:

Many of these network technologies are embedded into legacy systems or are supplied by specific vendors. Few will be switched off and replaced overnight with 4G/5G, even where that is an intended direction – there will likely be a migration period and perhaps hybrid solutions.

This means that mining operators, integrators and service providers will likely need to deal with diverse, heterogeneous networks – which may add costs and certainly skills requirements. Nevertheless, progress towards private wireless (and especially 4G/5G) is certain – and essentially for future mining productivity, safety and sustainability.