Private Networks for Transportation & Logistics

An overview of the challenges, market drivers, use-cases and trends for private networks in the transportation & logistics industry.

by Dean Bubley of Disruptive Analysis

Summary

The transportation and logistics sector is one of the most promising industries for emerging private LTE and 5G networks, as well as adjacent technologies such as edge computing and new Wi‑Fi 6E/7 versions.

Ports, airports and warehouses/fulfilment centers are among the most advanced adopters so far, while railway stations, large aviation/marine manufacturers and others are starting to exhibit interest as well. Highway agencies, railway networks and municipal transit systems are lagging, although they are showing more interest in neutral-host infrastructure, as well as future specialized versions of 5G aimed at vehicle-to-vehicle or next-generation rail connectivity.

Companies and public agencies in this (broad and diverse) sector are deploying many applications with demanding requirements for wireless connectivity in terms of bandwidth, predictable latency, security and uptime. Video-based uses such as security cameras or remotely-driven vehicles can be major private 5G drivers, especially where outdoor settings are unsuited to Wi‑Fi.

Given well-defined sites and a growing supplier ecosystem, transport hubs and logistics sites are rapidly becoming a key target for private wireless vendors and solution integrators.

Unlike many industries, transportation companies and organizations have long had sophisticated network infrastructure, often integrated with IoT and automation systems (“OT”, or “Operational Technology”), as well as more conventional IT and telecoms needs. As rail, ports and airports are parts of critical national infrastructure, they have often had highly resilient networks, and often dedicated technologies or spectrum for specific operational needs.

As all of these sectors become more automated and data-dependent, as well as facing growing challenges in both physical and cyber security domains. They also perform a central role in current shifts in global supply chains, as hubs for the distribution of containers, bulk products and smaller packages.

As 4G and 5G cellular matures, it is becoming “democratized” beyond traditional MNOs, by shifts in local spectrum and equipment availability. Private networks are now a growing reality.

Together, this is creating a match of supply and demand for private mobile networks, for onsite communications for staff, automation systems, vehicles, IoT sensors, cameras and infrastructure. This eBook outlines the main use-cases, deployment scenarios and paths to private 4G and 5G in transport and logistics industries. While this report focused mostly on the radio aspects, it is important to recognize that the broader ecosystem – from core networks to edge/cloud computing and planning / design / test systems – is evolving in tandem, along with a huge ecosystem of systems integrators and vertical specialists.

Definition of the transport and logistics sector

There are numerous transport and logistics sub-sectors and site types covered in this eBook. Although there are some common features and market drivers, there are also clear differences in locations’ physical size and layout, as well as equipment and application platforms, legacy/alternative wireless technologies, regulatory oversight and technology conservatism.

The key domains covered in this eBook include:

There are also often hybrid sites, such as FedEx’s huge logistics “hub” sites next to Memphis and Indianapolis airports.

There is also some overlap with various other sectors, such as major manufacturing sites. For instance, aerospace manufacture and maintenance typically occur at combined factories/airfields such as Boeing and Airbus’ facilities. Similar combined operations occur in shipbuilding and train production. Mining, steel and cement companies may even have their own private rail-lines, from remote sites or industrial zones to multi-modal transit hubs at ports or cities.

For logistics sites, it should be noted that many facility owners also have large retail networks (such as Costco and Walmart), or other sites such as Amazon’s AWS datacenters. Those ancillary operations and their specific applications are not directly included in this paper.

Key challenges and market drivers

The demand for private networks for the transportation and logistics sector is ultimately driven by a number of top-level national and global changes, in addition to certain local factors such as political support for “free ports” or enterprise zones, or efforts to modernize railway networks.

Broadly speaking, these all create a greater requirement for connectivity, control and information flows – which then translates to more 4G and 5G networks, as well as Wi‑Fi, fiber and wide-area network services.

Some of the key “megatrends” for logistics and transportation include:

Combined, all of these broad factors, as well as company- or country-specific trends, are combining to mean that networks need to be:

There is also a need for new network systems (such as 5G or Wi‑Fi 6/6E) to integrate with legacy connectivity types. This spans many different types of networking, both wired and wireless. Many of the more “Industry 4.0” features of 5G only become available in future, with later 3GPP Releases 16 / 17 / 18. This means that often multiple technologies will be used in combination, with a variety of integration or gateway approaches needed. Continual upgrades and refreshes are likely, as well as the addition of new use-cases.

(Also, outside the scope of this document, there is a huge amount of additional change occurring with network management and control, including cloud- and edge-based core networks and operational systems).

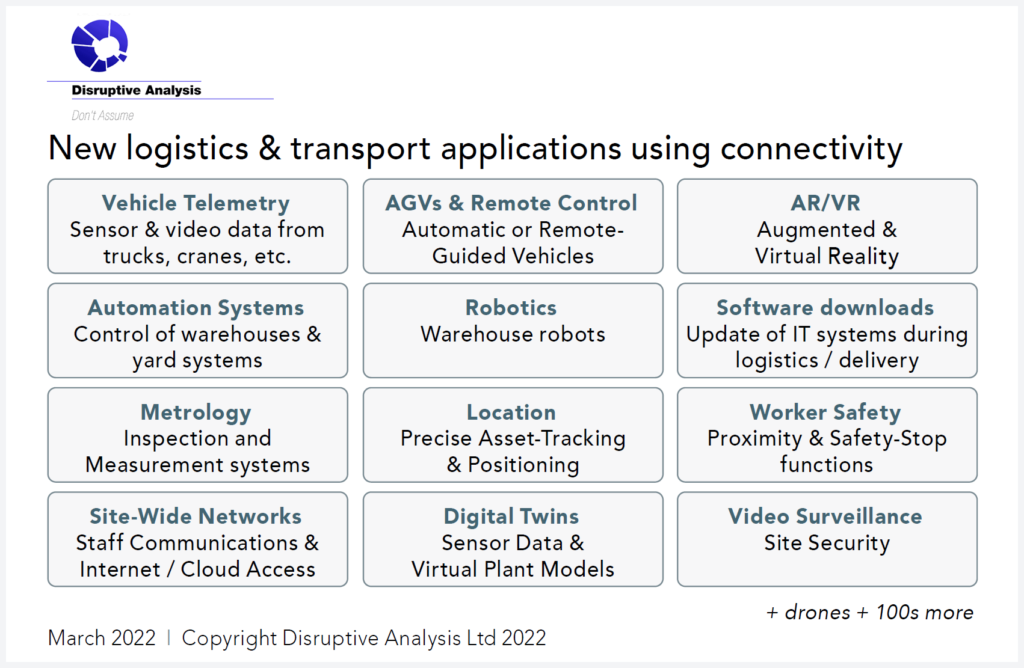

4G/5G use-cases in logistics and transportation

Given the industry structure and changes outlined above, there are two layers of questions to address in this report:

This section highlights some of the emerging use-cases that can benefit from cellular connectivity in the logistics and transportation sectors, especially for warehouses and fulfilment centers, ports and airports, which are probably the largest customers for private 4G/5G at the moment.

Other sectors such as rail networks and stations often have cellular coverage systems or neutral-host infrastructure for access to public mobile networks, but dedicated private systems are rare, beyond legacy GSM-R railway networks for critical operational communications. (Future 5G variants like FRMCS will change that, but are years away).

While there are likely hundreds of applications overall – and some such as general office IT are omitted for conciseness – the following are typical of the aspirations of many companies in these sectors.

Vehicle telemetry & condition monitoring

Modern transport and logistics vehicles generate huge volumes of data, from motors, batteries, transmissions, wheels, hydraulic systems and external sensors for temperature, vibration and many other variables. This applies equally to dockside cranes, container and passenger ships, train locomotives, trucks and especially aircraft.

The data is used for multiple purposes, from preventative maintenance (by spotting incipient problems before damage occurs), to mandated record-keeping. Some data is used immediately for operational reasons, while other input is used to optimize performance, reduce energy consumption, improve maintenance practices and feed into “digital twins” (see later).

Trains and aircraft may need fast “batch” upload of telemetry data when they pull into a station, or come onto stand at an airport terminal, perhaps just for a few minutes at a time. Potentially gigabytes or terabytes may need to be transferred in a short period of time, uninterrupted by Wi‑Fi congestion or contention for use of public cellular networks.

While some telemetry data will need to transit public 4G/5G mobile or satellite networks – for instance trucks on the road, or ships on the ocean – a large amount will be generated or sent “on campus” at ports, airports, logistics hubs and other privately-owned environments. The use of private 5G will be an important enabler for this type of application.

Automated or remote-guided vehicles (AGVs & tele-operation)

Various types of on-site and localized mobile vehicles and material-handling systems are used to move containers, packages or materials, either inside warehouse buildings or across larger sites such as ports. Inside buildings, automated guided vehicles or AGVs usually follow specific pathways and move quite slowly for safety reasons, separated from human workers. For larger outdoor areas such as container ports, much larger mobile units are used. Rail Mounted Gantry (RMG) cranes move along the quayside on tracks, while straddle carriers or Rubber Tyred Gantry (RTG) cranes have a greater range of movement around the container yards.

There is a significant shift towards remote-control or full automation of AGVs and cranes. This reduces risks of worker fatigue, removes safety hazards and eases recruitment challenges. They use connected cameras (sometimes ten or more) plus other sensors such as LiDAR, to analyze their surroundings, especially for safe use within the same spaces as human operators.

In future, airports are also likely to see more use of automated tugs, cargo tractors and baggage carts – with some already under remote control by human operators on the ramp. With high-definition cameras, plus sufficiently capable networks it should be possible to use a centralized control-tower for tele-operations for a large port or airport.

5G is an ideal connectivity option for this, supporting reliable and high-capacity upload of video, and low-latency downlink for control signals over wide areas, especially as the density of cameras and the height of some cranes is a challenge for Wi‑Fi coverage. Future URLLC (Ultra Reliable Low Latency) capability will allow tighter edge-cloud integration and oversight, as well as interactions conducted accurately with other machines such as conveyor belts, lifting systems or docking/electrical charging points.

The critical importance and safety implications of such vehicles will likely mean that networks have to have overlapping, redundant coverage, with each unit having good connectivity to two or more cells.

AR / VR processes and training

Certain transport and logistics sites are early adopters of augmented and virtual reality technology – a field that is also starting to be included under the term “metaverse”. AR headsets and glasses enable staff to work hands-free on complex tasks such as loading vehicles or select the right products from warehouse shelves. They can see shipment identification data, or see maintenance instructions displayed into their fields of view, or consulting remote experts.

As well as field operations, XR applications are useful for “back office” tasks such as product development and training. Designers can use VR to visualize new aircraft or train interiors. Simulations can identify the behavior of passengers or staff in new airport terminals or rail stations. A wide variety of training tasks can benefit from AR/VR techniques.

Although Wi‑Fi and wired connections tend to predominate for AR/VR today, 4G and 5G connectivity is becoming important for outdoor scenarios, or certain specialist applications. Cellular connectivity – as well as Wi‑Fi 6/6E – can also enable real-time AR streaming with some graphics tasks offloaded to edge-computing resource. This reduces the processing power required on the headset or tablet itself, extending battery-life or reducing the weight needed. Haptics (touch/sense) data transmission also needs low-latencies and high throughput speeds.

While few XR headsets integrate 5G chipsets today, they can be tethered to a cellular modem or mobile gateway. Future designs may include cellular options, especially for enterprise usage.

Automation Systems

As well as moving vehicles and robots, the core of many logistics facilities – especially for warehouses and fulfilment centers – is automation. They have hugely complex arrays of conveyor belts, sorting systems, collection bins and other elements. Similar automated systems work in airport baggage-handling zones, or some areas of ports and rail networks.

These systems require multiple layers of compute and communications here, from control of individual machines using PLCs (programmable logic controllers), through to cameras and weight-sensors for identifying particular shipments, or sorting them by type.

All of this requires connectivity, with extremely high reliability requirements, as well as low and often deterministic – that is, predictable – latency needs.

While fiber, Wi‑Fi and various proprietary wireless solutions have been widely used in the past, 5G offers the potential for greater flexibility and/or lower costs in future. It may also may perform better in environments with miles of metalwork and electromechanical noise.

That said, “5G-only” warehouses or ports are highly unlikely. Most automation systems suppliers work with multiple network types, integrating the most appropriate for each machine and application.

Tenant and passenger connectivity

Businesses in transport and logistics can have up to three separate “audiences” for connectivity:

The second two categories essentially turn the site owners into “semi-public” network operators. They either need to provide on-site access to national 4G/5G mobile carriers, or perhaps onboard these groups onto a private cellular network as some sort of managed service. Many will use Wi‑Fi as well.

Some sites like warehouses may be simpler, without the need to deal with 3rd-party groups.

Use-cases for “tenant and passenger” 4G/5G will include typical consumer smartphone use, or business applications used in those related sectors such as retail or hospitality.

There is a broad set of technology options for on-campus/indoor coverage and “neutral host” wireless service provision to MNOs. Mobile coverage on ships and aircraft in international seas or airspace brings its own challenges for networking, which are outside the scope of this eBook.

Robotics

Robots – both fixed “arms” and mobile units – are being adopted across the transport and logistics sector. Depending on definitions, some of these overlap with other categories such as AGVs (automated guided vehicles). Trends include

Warehouses and fulfilment centers are becoming especially automated. For instance in consumer eCommerce and delivery, multiple items need to be “picked” and combined into mixed packages for shipment. Some sites use traditional shelves and aisles with stacked pallets or large boxes, while others have “bins” of smaller products which can picked out individually from above with a robot.

Shipments and deliveries must also be loaded and unloaded from trucks and containers – a complex task given the variation in sizes, weights and fragility, plus the need for final delivery drivers to be able to extract individual packages at each address stop.

Ports and airports are also adopting a wide range of robotic systems, both for interacting with passengers in terminals, and for dealing with operational functions. Use-cases include:

All of this is driving the need for more (and better) wireless connectivity for robotics. Again, 5G is seen as an important enabler in many cases. Low latency and high reliability are essential to avoid collisions or enable remote control in case of problems. Individual warehouses may have 1000s of individual robots, ranging over very large facilities, including outdoor areas.

In addition, 5G’s improving location/positioning capabilities are very important in warehouse settings, and also enable proximity-sensing between humans and mobile robots to be more accurate. Wi‑Fi also remains important – and later versions such as Wi‑Fi 6E and the future Wi‑Fi 7 will help – but can suffer from congestion or interference in areas with lots of metalwork.

Bulk software downloads

A new 4G/5G use-case in logistics settings is management of software downloads to products in the supply chain. In particular, cars and other vehicles may receive custom software installations (or updates) relevant to particular countries on arrival. For example, it is common to have huge vehicle storage facilities alongside shipping ports, perhaps with 1000s of car awaiting onward delivery.

Modern vehicles – as well as other products such as industrial equipment and consumer electronics – may have many gigabytes of software embedded in their control systems. Being able to download updates “in the field” is hugely useful. However, this can require significant network capacity, often in outdoor areas with limited public network coverage. Cast-iron security is also important.

Private 4G/5G networks offer a mechanism for this type of application, especially as the vehicles will typically have embedded modems and a power source. Beyond cars, a similar approach could be used in other transport contexts, such as content uploads to aircraft entertainment systems or pilots’ “digital briefcases”.

Metrology

Metrology means “the study of measurement”. It is a broad term covering a wide variety of activities and systems. However, in industrial settings such as transport, logistics and engineering it often represents the use of cameras or lasers to measure (or inspect) objects.

In the context of this eBook, the most important examples of metrology are in the production and maintenance operations for aircraft, trains and other vehicles requiring precision engineering for reliability and safety purposes.

For instance, aircraft and their engines regularly undertake inspections for tiny cracks or other signs of possible failure. This often takes place in the large hangars seen around major airports. Ships, locomotives, trucks, buses and other vehicles also have rigorous maintenance regimes.

Another area for metrology is in logistics and warehousing – whether that is for pre-shipping quality checks, measurement of package size for efficient loading, or specialist use-cases such as temperature-mapping for stored pharmaceuticals and food.

Some measurement devices can take millions of readings per second, generating terabytes of data per day. That is in addition to “normal” video feeds for similar purposes. This data may well exploit AI-enhanced approaches can analyze patterns, or detect flaws which may not be visible to the human eye. Machine-vision systems on-premise or in another edge-computing site can analyze such data, ideally in real-time.

While some metrology systems will be wired-in to other units, there is also a need for portability and mobility. Increasingly, such equipment uses wireless networks with high performance and throughput – especially where used in combination with robotics or drones. 5G is likely to play an important role in some settings, especially in locations which are tricky to connect with fiber.

Precise asset location and positioning

There are numerous purposes for asset-location and real-time positioning in logistics and transport environments. Robots and AGVs need to locate specific shelves or storage bins. They also need to dock accurately with charging stations, accurately record the location of any faults, and ensure safe distances from human workers.

As an example, airport assets like aluminum shipping crates, baggage carts and wheel-chocks need to be tracked and located, as well as other assets such as luggage trolleys which are frequently moved around. Similar requirements occur in railway stations, ports, logistics hubs and other similar sites.

Accurate positioning can improve productivity and asset utilization, as well as reducing the risks of theft by “geo-fencing” within specified boundaries. Tracking technologies also contribute to preventative maintenance, by ensuring items are stored in correct locations.

It is already possible to use a variety of wireless technologies (including private deployments of 4G NB-IoT) for asset-tracking, but real-time positioning, especially indoors, is hard.

Later versions of 5G, especially 3GPP Release 17 onwards, will permit highly accurate location tracking, down to centimeter-scale positioning. On a well-engineered private network, this would have multiple use-cases in aviation hangars and terminals, fulfilment centers and other locations. Linking private and public networks could also allow passengers to track their bags, or for individuals and businesses to locate package shipments and deliveries.

Worker safety systems

A key application for private networks in transport, logistics or other industrial settings is enabling companies to maintain worker safety more effectively. This is important for reputation, compliance, liability and other reasons. There are a number of elements here requiring good connectivity:

Depending on the specific site, these functions may be needed both inside buildings such as warehouses, and outside on a dockside or airport ramp, and even in underground areas or inside vehicles.

“Smart work-wear” such as helmets or jackets can now be obtained with built-in cellular radios.

Private 4G/5G allows for reliable connectivity, with customized coverage and uptime guarantee that would be hard to obtain from public networks, and in locations that would be hard to reach with Wi‑Fi.

Site-wide networks & workforce communications

Ports, airports and logistics hubs span areas that can be up to 10km across. Many have their own road networks, as well as open areas that can span long distances across runways or waterfront. Certain transport sectors such as railways and road networks obviously span even greater distances. Staff, assets and vehicles may be distant from the operations center, and need to be contactable and controlled in real-time.

For such sites, it is essential to have site-wide (or “campus”) networks, covering both outdoor and indoor areas. Often, some or all of the site is poorly covered by public mobile networks.

Reliable site-wide connectivity is needed for various applications and service functions, such as:

Cellular 4G/5G networks are more flexible than traditional site-wide VHF radios or PMR (private mobile radio) systems – and support data applications with far greater capacity. Wi‑Fi can be used for small sites such as railway stations, but is less viable for the larger facilities. The ability to issue private SIM cards to relevant staff – or contractors and suppliers – allows easy creation of “closed user groups”.

Video surveillance systems

Transport and logistics sectors have significant needs for video surveillance, as well as video-based analytics for operational purposes. Locations such as ports, warehouses and airports have critical needs to monitor security and safety risks such as terrorism threats, fire, intrusion and theft or other illegal activities, potentially over large site area, both indoors and outdoors. Both perimeter surveillance and local video of the most-sensitive areas such as baggage-handling are essential.

Some sub-sectors such as aviation manufacturing and shipbuilding face additional risks from geopolitical actors or espionage.

Wireless connectivity with 4G and 5G allows extra capacity for high-resolution imaging, as well as reduced latency. Increasingly, cameras are attached to mobile assets such as vehicles, robots and drones, which obviously necessitates wireless access. While most cameras need cabling for power supply, even wired units may connect to a 5G-enabled hub or gateway.

Over time, edge-computing combined with machine vision will enable additional automation, as well as immediate alerting of anomalies

Other use-cases

There are numerous other use-cases for private networks and 5G emerging in transport and logistics. Some will be highly sector-specific. Some examples include:

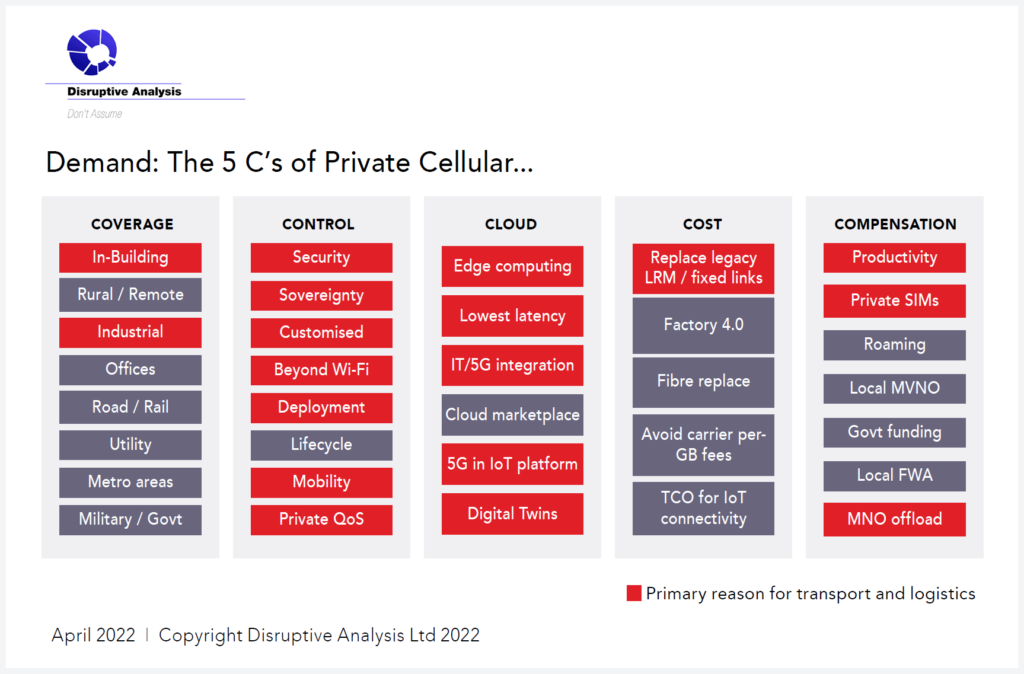

Why deploy private networks?

The second question mentioned above is at the core of this report. Why are these use-cases better suited to private 4G/5G rather than public network services from MNOs?

Coverage

A core reason for using private 4G/5G, rather than public MNO services, is the limitations of network coverage. MNOs tend to deploy network assets in areas with high population density, or along main roads. (Often, their spectrum license conditions stipulate coverage requirements in terms of resident population).

However, ports and warehouse hub sites tend to be located away from major population centers and normal residential / business districts. As a result, many transport and logistics companies’ facilities often have relatively poor coverage. Even where public coverage is quite good – such as airports – most of the RAN planning will focus on the runway and terminals for passengers, rather than maintenance and other operational parts of the wider airfield area.

In addition, in-building coverage is especially poor for warehouses, given the common use of metal and concrete in construction, fewer windows compared to other sites, and various forms of screening and internal metalwork. At airports, baggage-handling and other service functions may be underground, while ports may need good wireless coverage to extend over expanses of water.

Control

Alongside coverage, this is the most important aspect of private networks for most transport and logistics companies. Many firms, especially ports, airports and automated logistics/fulfilment hubs, have extremely high costs of any downtime, as well as being very protective of network security and safety concerns.

Owning and operating 4G / 5G wireless systems allows companies to define and optimize many network parameters themselves, taking direct responsibility for QoS, reliability, performance and reporting. For instance, a number of ports operate “fully redundant” cell sites, where any individual tower can go offline, yet full coverage and operation is maintained across the site. Aviation maintenance centers, with heavy use of video uplink from video inspections and metrology systems, can configure radios locally to reflect the traffic balance.

Private networks also mean that enterprises can choose their own mechanisms for redundancy and cybersecurity, aligning with sector-specific best practices and regulations. This is particularly important in areas such as rail, where there is a long history of unique standards and compliance approaches.

In the longer term some of the sectors here may acquire a custom “slice” of a public MNO 5G network via various APIs and “network exposure” capabilities, but this remains an unproven model and is only fully available when future versions of the 5G technology (3GPP Releases 17 / 18) become widespread.

There may also be a requirement to integrate the private cellular domain with other connectivity systems – such as PMR/LMR for critical communications, or with existing Wi‑Fi installations. The added complexity and customization requirements may mean that public 5G network operators are unsuited to those tasks.

Cost (and risk-avoidance)

Transport and logistics companies have traditionally had relatively limited use of public 4G/5G networks for on-site use, beyond vehicle fleets which require onsite and offsite connectivity, or passenger terminals which have required good coverage from MNOs.

However, they have often used other expensive, proprietary (and sometimes near-obsolete) radio systems for push-to-talk communications, or low-speed data connectivity. Private 4G/5G networks can be enable both reduced costs of ownership, and higher data throughput to support new applications. Further potential cost savings from private cellular are related to reducing the need for new fiber runs, especially for perimeter security cameras, or IoT devices in inaccessible locations such as rooftops.

The more complex cost calculations may come in future, when MNOs attempt to sell managed 5G services (perhaps in the form of “network slices”) to enterprises in this sector. These will essentially compete with private cellular offerings, although various hybrids are likely. Indeed, some MNOs now sell dedicated on-premise 4G/5G solutions as private networks themselves.

Cloud

While certain subsectors such as rail are “conservative” about adoption of cloud technologies, others such as logistics demonstrate a growing link between private wireless and cloud platforms. The intersection point typically involves the use of on-premise or near-premise edge computing. (Notably, Amazon operates distribution warehouses of its own, alongside its AWS cloud services – and now its own Private 5G capabilities).

There are two linked trends here:

In coming years, there is likely to be even greater integration with private networks and edge-cloud requirements in transport and logistics sectors. Growing emphasis on automation and cybersecurity will drive the need for better (and more resilient) wireless networks for critical infrastructure sites, often with “sovereign” cloud/compute onsite as well.

Compensation / Monetization

Some of the transport sectors covered here, such as airports, can directly monetize private 4G / 5G by offering connectivity services to onsite tenants such as airlines, catering companies and others. Heathrow Airport in the UK, for instance, has its own Commercial Telecoms business unit, run in conjunction with industry group SITA.

In future, private networks at transport sites may also offer neutral-host functions to public MNOs – essentially “coverage as a service”.

There are also private cellular networks in operation on certain ships and aircraft, selling access or roaming services to their passengers.

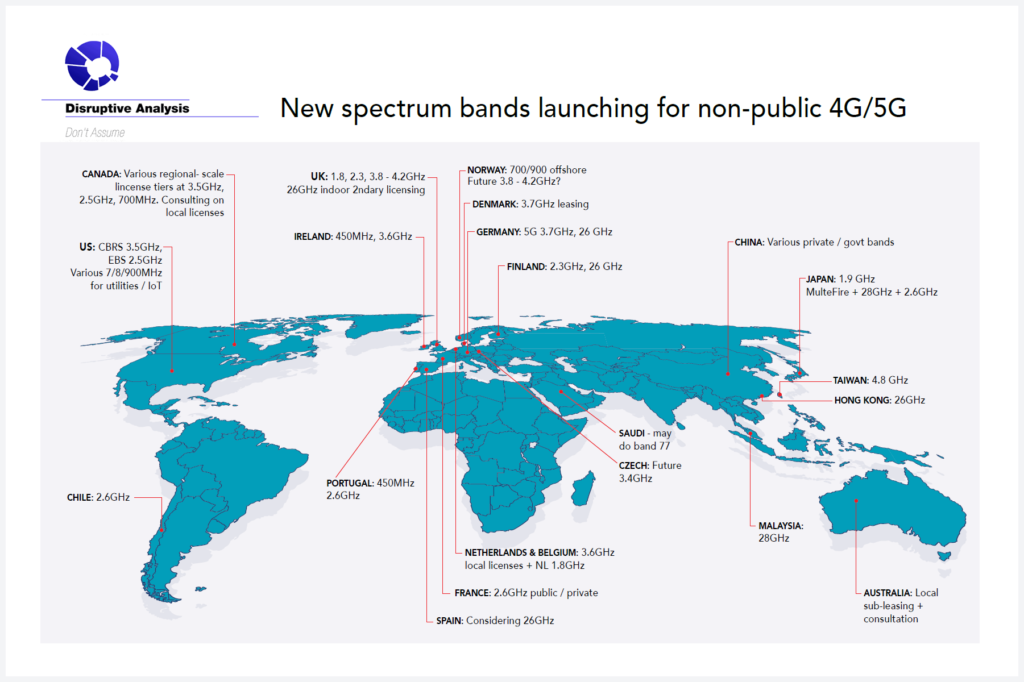

Spectrum options and trends

Overview

A key ingredient for transport/logistics-sector private networks is access to suitable spectrum for private 4G/5G deployments. Decisions and trends here involve a huge range of trade-offs in terms of coverage, capacity, cost, device availability – and also politics and regulation.

It also directly relates to the relevance and potential for “pure” private networks run by enterprises or specialists, versus those that are provided as a managed service by a mainstream telco that primarily runs public 4G/5G networks.

Although most spectrum suitable for cellular networks has been awarded on an exclusive regional/national basis to public mobile operators (MNOs), some transport sectors such as rail and aviation have had access to certain dedicated bands for operational reasons. Along with utilities, transport is often seen as “critical national infrastructure” and is treated differently to commercial sectors like manufacturing, logistics or local transit authorities by regulatory authorities. The latter groups have historically had far less direct access to such mainstream cellular bands without rare and complex leasing arrangements

This is now changing rapidly, as various national regulators make local licenses or various forms of shared spectrum available – and device / chip companies start to support them as well. As mentioned above, MNOs are also becoming more open to a range of new engagement models, including the creation of private campus networks decoupled from their main macro RAN and core infrastructure.

For private networks in transport/logistic sectors there are, broadly, three spectrum options:

The following sections give more detail on some of the specific bands being made available around the world.

CBRS and other mid-band options

For site-specific or regional coverage, a growing number of countries are making sections of mid-band spectrum available for transport and logistics companies and organizations. Typically this is based on some form of spectrum-sharing, with either manual or database-driven licensing for specific areas and band rights. Sectors such as ports and warehousing/logistics have been some of the most powerful voices persuading governments and regulators of the potential economic benefits.

Among the most important examples are:

A number of other countries in Europe and the EU regulatory advisory body RSPG have also suggested the 3.8-4.2GHz band for future potential shared/enterprise use. Many other countries have ongoing regulatory initiatives or consultations on suitable mid-band options for industry, including Spain, India and Saudi Arabia.

Other markets have the potential for local leasing of MNOs’ allocated national spectrum (for instance in Australia, Sweden and Denmark), or the ability for regional operators specializing in industrial networks to obtain ordinary licenses in sparsely-populated areas (for instance in parts of Canada).

The main exception is probably China, which still tends to favor MNO national licensing.

It is also worth noting the potential for using unlicensed bands at 2.4GHz, 5GHz and increasingly 6GHz as well for private 4G/5G – although the lack of interference protection may limit the scope for mission-critical applications.

Sub-1GHz options

Low-band spectrum has only limited relevance for logistics, but is highly suitable for private wide-area communications in rail or road sectors. Its good indoor / underground propagation may also be useful for IoT and mission-critical voice communications, in some cases such as airports.

A number of markets have made such bands available to.

It is also possible to use narrowband IoT versions of 4G (NB-IoT & LTE Cat-M) in the various sub-GHz allocations, either licensed or unlicensed.

mmWave

A number of countries, including Germany, UK, Finland, Malaysia and Japan, have made 26GHz, 28GHz or other high-band spectrum available for local use. In the US, Italy and South Korea, some MNOs are also examining opportunities around mmWave private networks. This is mostly targeted at indoor/campus sites such as warehouses and mines, as well as high-density passenger areas such as airport terminals. However, there is also potential in areas such as ports and rail yards.

Key use-cases are for local high-capacity usage, such as remote-driven vehicles or high definition cameras, especially where mounted on vehicles, cranes or robots.

Copyright Disruptive Analysis Ltd 2022

Conclusion & long-term futures

The transport and logistics sector is already one of the leaders of the mainstream adoption of private cellular networks. It blends the early sectors requiring “critical communications” with more advanced uses of private 4G/5G in the realm of IoT / OT (operational technology) connectivity.

Among the keenest advocates of private cellular today are shipping ports and airports, which combine multiple high value use-cases on mid-size campuses, with high levels of existing technical skill and wireless connectivity usage. Many of the more valuable functions occur outdoors, where Wi‑Fi and fiber are poor alternatives.

Modern warehouses and fulfilment centers form another category where private 4G/5G has been rapidly adopted, helped by high levels of automation, and an explosion in “greenfield” new-built sites in the eCommerce / delivery boom, designed from the ground up around robots and IoT systems.

While this report has focused on the radio aspects of private 4G/5G, it is important to recognize that the broader ecosystem – from core networks to edge computing and planning / design / test systems – is evolving in tandem, along with a huge range of systems integrators and vertical specialists.

There is growing maturity of enterprise-grade 5G technology, especially with transport-related features in 3GPP Release 16/17/18. Together with the wider availability of local or dedicated spectrum, there should be a continued healthy dynamism for many years to come. By 2025 there may be 1000s of private networks in transport and logistics, and perhaps tens of 1000s.

In addition, while greenfield logistics/warehouse sites may be “5G primary”, in most instances there will be significant installations of other network technologies in place. Ports, airports, rail stations and similar organizations will maintain a complex array of networking and wireless technologies for different purposes – from Wi‑Fi connectivity for passengers, to radar systems and dedicated train/air-traffic control protocols. There will also be many incumbent suppliers such as aviation systems or train manufacturing companies, that will often act as channels or integrators for (often own-branded) connectivity systems. The 5G industry needs to fit into, or around, these incumbents.

Table: Examples of Transport / Logistics private 4G/5G deployments/trials

| Company | Country | Sector/Purpose | Spectrum/Owner |

|---|---|---|---|

| Port of Southampton | UK | Coverage of automotive shipping / storage | Local shared 3.4-3.8GHz |

| Heathrow Airport | UK | Ramp vehicles & other uses | 3.5GHz (3UK band) |

| Brussels Airport | Belgium | Many uses, inc security cams, IoT, drone control, automated vehicles | 3.5GHz (LTE + 5G) |

| CDG Paris Airport | France | Gate-side group voice & data comms for aircraft turnaround. Also in-hangar usage | 2.6GHz LTE + 5G tests |

| Lufthansa Technik | Germany | Jet engine maintenance / remote inspection | 3.7GHz Private 5G band |

| London St Pancras Stn | UK | Rail station IoT condition monitoring | 3.8-4.2GHz 5G |

| Amazon Fulfilment Ctrs | UK | Truck control / cameras outside Amazon warehouse | CBRS Private LTE |

| Ferrovial / Silvertown Tnl | Poland | Road tunnel construction automation / data | 3.8-4.2GHz Private 5G |

| Tokyu Railways | Japan | Trial of 5G cameras + AI for track abnormality detection + on-platform for safe door-closing | Thought to be 4.6-4.9GHz local 5G band |

| Port of HaminaKotka | Finland | Video & analytics, vehicles, worker PTT etc. | 2.6GHz Private LTE |

| Port of Rotterdam | NL | Container-handling vehicles | 3.7-3.8GHz Local LTE |

| Saab | Sweden | Aerospace manufacturing IoT | 1.8GHz LTE , 3.7GHz 5G |

| Zyter | US | Smart warehouse system, inc AGVs, AR/VR, digital twin & IoT sensors | CBRS Private LTE |

| Ondas Networks | US | Critical communications for Class 1 railways | 900MHz Private LTE |