Private LTE & 5G Networks

Accelerating Towards a Mature Marketplace

A Disruptive Analysis Thought-Leadership eBook – October 2023

Introduction: Private Networks Come of Age

Background and Objectives of This eBook

This eBook gives a top-level view of the evolution of private 4G and 5G networks, how they are enabled and delivered, and the rationale for enterprises and other organizations to deploy them.

It covers both the US market, where the CBRS spectrum band has become almost synonymous with private cellular, and encompasses the broader global environment, where there are some important differences – and major opportunities.

Readers should be aware that iBwave has published a significant number of other eBooks and articles on this and related areas. There are specific resources available about 5G use cases, top-level innovations, and trends in private networks, as well as several publications about particular verticals such as mining, utilities or transport. A full catalog of eBooks can be found here.

To avoid too much overlap, this eBook focuses on the following key aspects of private 4G and 5G:

What Has Changed?

In 2019, iBwave and Disruptive Analysis published an initial ground-breaking eBook about Private LTE and CBRS. At the time, the concept was novel for many businesses. The report examined the rationale for enterprises and others to deploy private 4G cellular, as well as the US opening of the 3.55-3.7GHz CBRS band as a key catalyst for the market.

Since then, there has been a huge surge in innovation and deployment, with numerous applications and vertical sectors driving adoption. The US market for private wireless has been vibrant, alongside parallel growth in places such as German, UK and Japan. Certain sectors have exceeded expectations in terms of adoption, while others have not lived up to the initial hype. Some countries have been slower to adopt the concept, often wary of new competition for traditional mobile operators hoping to sell into the B2B marketplace.

Initially, the focus of CBRS and similar initiatives was on private LTE/4G. But over this period, private 5G has become more viable, alongside the maturing of private 4G – although adoption has been slower than initially predicted. The vendor landscape and value chain has evolved hugely, with multiple new stakeholders emerging with a complex mesh of partnerships. Going forward, 5G – especially with “standalone” core networks, cloud-based “network-as-a-service” propositions, and new features in future standards releases – will become central to private cellular in most instances.

Not everything has been straightforward, however. While regulators and governments around the world have made spectrum available for private 4G/5G, it spans a fragmented range of different bands, with widely varying rules for allocation and use. There has also been patchy availability of suitable end-devices, although that is now improving. Other essential elements, such as design and test tools, systems integration expertise, and in-house skills and training are now maturing as well.

Definition, Scale & Scope of Private Networks

Definitions

Simplistically, private networks are 4G/5G systems designed for specific sites or companies. Sometimes Wi‑Fi is included as well, but few observers would call a Wi‑Fi-only installation a “private network.”

However, the reality is not that simple.

Even the term “private network” is not universal. Some vendors and commentators refer to “dedicated networks” or “private wireless.” Others refer to them as “campus networks,” “local networks,” “enterprise networks,” or “vertical networks.”

One of the challenges in defining and assessing the market for private networks – even just restricted to private cellular networks – is the sheer diversity of network types and use cases that are being proposed and deployed, compared to the “traditional” national public MNOs or wireless carriers.

These may or may not include other technologies beyond 4G and 5G – some include Wi‑Fi, local meshes, point-to-point microwave, TETRA/P25 or various IoT and proprietary connectivity systems.

Even the 3GPP’s clunky and somewhat-disparaging term NPN (“non-public network”) is not particularly useful, as various current “public” networks (defined as having a government-issued PLMN ID) include unusual providers such as railway operators, public safety agencies, MVNOs and wholesalers.

It is also unclear whether various types of “private partitions” of public networks should be included here – in particular, the idea of 5G network slicing applied to local networks or specific enterprises. There are also various hybrid models, such as the use of a national radio network with a degree of local “semi-private” control and coverage extensions.

The confusion is unhelpful, especially when related topics such as radio spectrum and wider government industrial policy considerations are blended into the discussion.

They broadly cover three options:

Scale

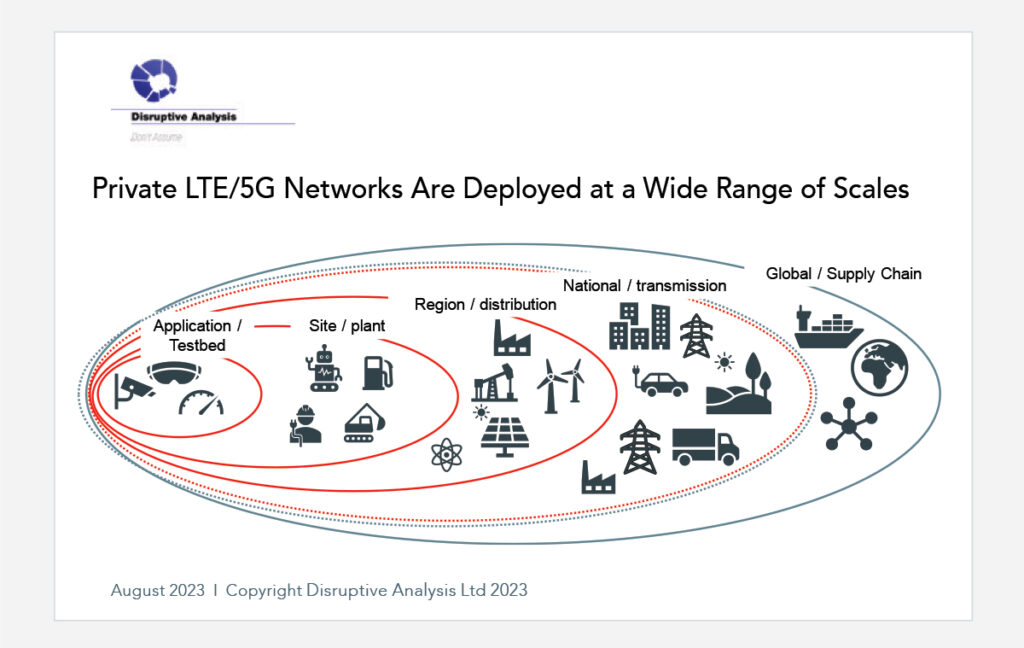

It is worth stressing that private LTE & 5G deployments vary widely in scale. They can be nationwide networks (for example, for utility grids, public safety, or rail), or highly localized, such as for an individual factory, ship, or hotel.

In the future, they may even scale down to a small individual office, store or even home.

However, from the perspective of most enterprises, the current “sweet spot” for private cellular is in the 1-10km site size range – which covers most major industrial plants, ports, airports, mines, energy facilities, major sports venues, and universities. Such locations typically have multiple use cases, outdoor and indoor areas, and often include challenging zones for either public cellular or Wi‑Fi to cover.

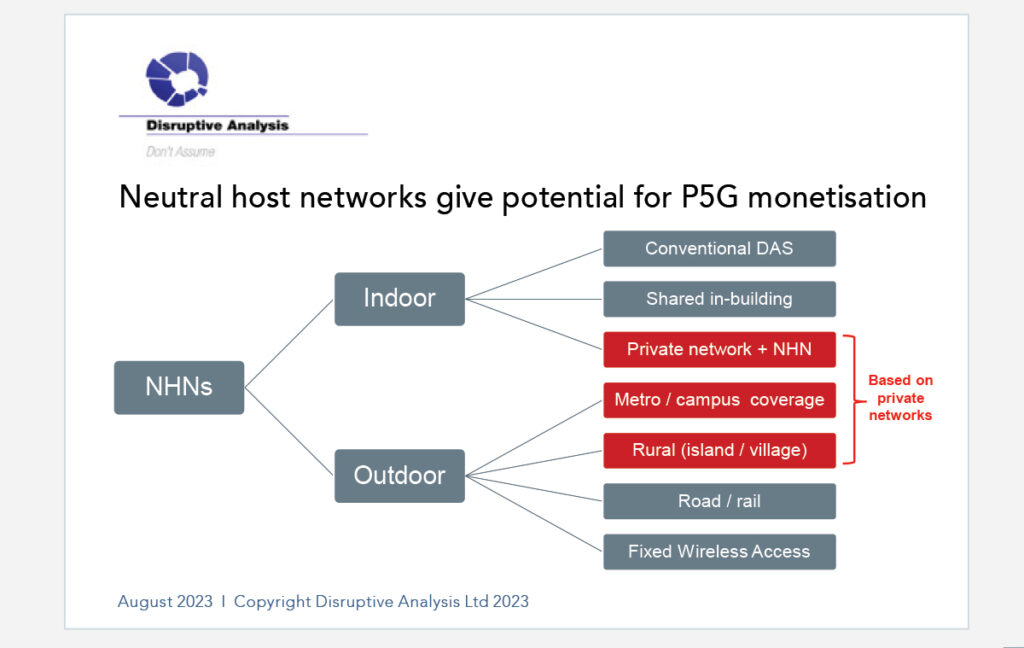

Larger private networks tend to be special cases, often with dedicated spectrum and government involvement as part of national infrastructure projects. Smaller private networks are likely to be oriented on single buildings, with an emphasis on indoor coverage and highly specialized applications, or perhaps a need for “neutral host” services for public network tenants.

Market Size and Growth of PLTE/P5G

Private cellular is not new. The market has existed for over 20 years. In the past, small numbers of 2G/3G/4G networks were used at some mining sites, oil and gas extraction facilities, military bases, and other locations where public cellular carrier coverage is absent or unsuitable. Rail networks have used special variants such as GSM-R. But these networks were rare – maybe a few hundred worldwide, often designed and deployed at considerable cost by specialist providers and managed by expert staff.

However, the advent of more mainstream spectrum availability – especially CBRS in the US and local licenses in Japan, Germany and the UK – has, together with new small cells and cloud platforms – led to rapid expansion in the last 3-4 years, with many experts viewing this as an inflection point for accelerating adoption.

Various estimates and forecasts of the private network market have been published by analyst firms, vendors, and trade associations. Most methodologies now point to low 1,000s already deployed worldwide, although widely varying in scale and with a mix of trial sites and “production” facilities. It is realistic to forecast that figure expanding to 10,000s of networks in the next five years, or even optimistic scenarios with another zero or two by the end of the decade.

Many in the private 5G industry hope to make private cellular “as easy as Wi‑Fi”, although that seems to be something of a stretch. It is, however, fair to describe it as becoming progressively “democratized.” A similar ambition is held within the public MNO sector around network slicing, although that (as discussed later) seems less realistic.

Some industry associations, such as the GSA, use an arbitrary cutoff of only counting networks costing >US$100K, to exclude smaller installations from market size estimates. That seems a poor fit in an era of cloud-delivered 5G NaaS with promises of “no upfront capex”, or scenarios where multiple small networks may be deployed by a single company across many sites, for instance, in retail.

Disruptive Analysis has created its own forecasts for the private and dedicated LTE/5G market, in terms of installed base of sites. It has split these into two size categories for simplicity – large, mostly outdoor networks of 5km2 or above, and small/mid-size networks for indoor use and smaller campuses, below 5km2.

The first segment covers areas for oil and gas fields, large airports, wind farms, utility and rail networks, smart cities, and local fixed-wireless access for communities. The smaller sites include factories, logistics hubs, most university campuses, and indoor/outdoor use in offices and retail stores. It should be stressed that these figures are rough estimates and have many sensitivities to unpredictable regulatory and market conditions.

The market has several phases on the way to mass-market deployments and is currently transitioning from early commercial uses and smaller trials, to mainstream and “productized” installations. The next big jump will occur with multi-site private network use in sectors such as retail, plus wider use of indoor cellular for neutral-host coverage.

It is also worth noting that there is a separate “legacy market” of older 2G and 3G private networks, which may account for 10,000+ small sites, in Japan, the Netherlands, and the UK, where small amounts of local spectrum have been available for a long time.

Similarly, broad ranges are cited in terms of financial market value and revenue from private networks. Several sources assert an opportunity ranging up to $5-10 billion annually in the medium term, although that presumably must include infrastructure, devices, integration services and much more.

4G or 5G?

This eBook considers both 4G and 5G private networks, reflecting today’s market reality, which includes both technologies. The migration to 5G in the sector is discussed in more depth in an earlier publication on 2023 Private Network trends.

There are several considerations here, from both the demand and supply sides:

This is broadly similar to what is seen with other network technologies. Some applications demand innovative products and the highest performance and are designed with future-proofing in mind. Others are better suited to more mainstream, well-understood solutions at lower costs.

Over time private 5G will start to become more commoditized, with variants such as the future 5G RedCap variant reducing price points, but for the next 2-3 years, we can expect a heterogeneous mix of 4G and 5G, sometimes on the same sites.

Community Networks, Neutral-Host and Fixed Wireless Access

The main emphasis in the private network sector is around enterprise and industrial “vertical” use-cases. As discussed in this report and other iBwave eBooks, that spans domains such as manufacturing, mining, oil & gas, education, and transportation/logistics.

But these well-understood industries are only part of the broader story for private or localized 4G/5G networks. Vendors, systems integrators, and network design professionals should also be aware of other adjacent sectors that use broadly similar networks, spectrum, and tools:

Motivations and Use-Cases

Rationales for Private LTE/5G

As noted in the introduction, there are many different types of private networks being deployed or designed. Every vertical and every site will have its differences. Together, they span an extremely broad array of applications, organization types, and underlying rationales. However, some broad general themes can be seen. The key business reasons for considering private cellular networks include:

Coverage

The core reason for using private 4G/5G rather than public MNO services is the limitations of public network coverage. MNOs normally have license conditions – and financial targets – that prioritize covering residential populations, and so tend to deploy network assets in areas with high population density, or along main roads.

In addition, network upgrades such as 4G-to-5G tend to proceed in a similar fashion, which means that marginal or low-population areas are often a generation behind. and often rely on spectrum bands that are more favorable for broad coverage than capacity and enhanced features.

This means that there is often poor or unreliable network coverage in places such as:

These are also often the same types of locations where many enterprise or dedicated networks are needed most. As a result, private networks’ key role is in the provision of dedicated, high-quality coverage suitable for an enterprise’s activities.

It is worth noting that such areas are also often lacking good backhaul (fiber) connectivity, which may mean that self-contained “network in a box” solutions are needed with on-premises cores, or perhaps satellite connectivity.

Control & Security

Owning, specifying and/or operating private wireless allows companies to define and optimize many network parameters themselves, taking direct responsibility for security, reliability, performance, and reporting.

Many organizations have their own compliance needs, which means they may be hesitant to allow confidential operational or personnel data to go outside their own IT domain, across networks and servers over which they have limited visibility – even those operated by major MNOs.

With private networks they can choose their own mechanisms for redundancy and cybersecurity, aligning with sector-specific best practices and regulations, or the requirements of vehicles and specific analytical compute functions. They can employ their own preferred identity credentials and encryption mechanisms. For demanding applications like streaming video or low-latency remote control of machinery, they can customize and optimize radio resource management and redundancy.

For instance, high-definition cameras need more uplink capacity than may be available on public networks, especially in TDD (time-division duplex) spectrum bands primarily intended for consumer usage of streaming media and downloads. Using dedicated 4G/5G networks and local spectrum licenses, they can optimize for traffic flows of this type.

Other elements of “control” include:

Cost

Private 4G/5G networks span a large array of costs and business models. They may save direct costs compared to alternative network technologies (or public 4G/5G services) or may be elements in a more complex calculation of “total cost of ownership” or help mitigate operational risks that could lead to severe financial losses.

The costs of wireless networks for some industrial verticals are a comparatively small proportion of overall site expenditure on capex and opex. There may be some pricing advantages of private 4G/5G compared to older radio systems or microwave links, but the real benefits may come from the ability to connect more endpoints – whether those are IoT sensors, modules for vehicles and machinery, or higher-specification handhelds for workers which can support data and productivity applications.

One of the key benefits that has been realized in recent years is the ability to use 4G/5G to create more flexible and reconfigurable workplaces, without the need to re-wire fiber or ethernet connections. This is an important advantage for Industry 4.0 and Smart Factories, for instance, where production modules may be moved around a facility, and fiber connections would involve re-concreting parts of the floor. A similar calculation applies to connecting cameras deployed for perimeter security or other purposes.

In connection with the Control theme described above, it is often a requirement to replace wireless legacy equipment with modern, multi-functional and ideally cheaper alternatives – while keeping the historical levels of performance and security. This may involve migrating gradually over time from one to the other. This includes industrial network protocols, DECT and private two-way radio systems, and little-used wired networks in offices.

There may also be a desire in some businesses to avoid being locked-in to specific MNOs or paying per-use for connectivity that could more cost-effectively be delivered via Capex rather than Opex. Conversely, some of the emerging cloud-delivered “network as a service” models for private networks may enable a switch back to an Opex-based model with low capital outlays.

Various comparisons are often made with Wi‑Fi networks. In general, private 4G/5G requires fewer network nodes to cover an area – but devices, systems integration, and hiring appropriately-skilled people may be more costly.

Not all private cellular networks can be considered low-cost options. Some industries (such as utilities or transport hubs) may deploy “carrier-grade” or better networks, with multiple layers of redundancy and backups – for instance, the ability to support full connectivity on a site, even if one of the base stations or radio units fails.

Cloud

Historically, private cellular networks have evolved separately from cloud technologies. They have often been deployed in difficult areas for connectivity, such as mines and oilfields, or else have been in critical-infrastructure sectors which have been heavily reliant on dedicated computing hardware, such as rail and utilities.

However, the maturing of both cloud and private 4G/5G in the wider enterprise marketplace means there is a growing link between private wireless and hyperscale platforms.

There are two main trends here:

Many software elements, such as network cores, are being delivered via virtualization and containers, rather than physical appliances. Large cloud platform providers are increasingly offering their customers “network-as-a-service” functions, either for the entire private 4G/5G solution, such as Amazon AWS Private 5G, or for specific elements and capabilities, such as Microsoft Azure Private 5G Core. HPE recently acquired Athonet, which offers cloud-managed private cellular capabilities. They are also frequently linking private cellular with their managed edge computing services and solutions.

More broadly, cloud-based applications are being deployed for running and optimizing enterprise operations. For instance, cloud-managed IoT platforms may enable preventative maintenance, digital twins, AI, or broad control over supply chains and multi-site operations. Such systems use far more data, from many more sensors, machinery, cameras and input sources. This volume inherently needs networks with better coverage and much greater capacity, as well as support of mobile endpoints such as vehicles or wearables. That aligns well with private cellular use cases, so large “transformation” projects may include both cloud and connectivity combined.

Compensation and Monetization

Private 4G/5G networks span a large array of costs and business models. They may save direct costs compared to alternative network technologies (or public 4G/5G services) or may be elements in a more complex calculation of “total cost of ownership” or help mitigate operational risks that could lead to severe financial losses.

The costs of wireless networks for some industrial verticals are a comparatively small proportion of overall site expenditure on capex and opex. There may be some pricing advantages of private 4G/5G compared to older radio systems or microwave links, but the real benefits may come from the ability to connect more endpoints – whether those are IoT sensors, modules for vehicles and machinery, or higher-specification handhelds for workers which can support data and productivity applications.

One of the key benefits that has been realized in recent years is the ability to use 4G/5G to create more flexible and reconfigurable workplaces, without the need to re-wire fiber or ethernet connections. This is an important advantage for Industry 4.0 and Smart Factories, for instance, where production modules may be moved around a facility, and fiber connections would involve re-concreting parts of the floor. A similar calculation applies to connecting cameras deployed for perimeter security or other purposes.

In connection with the Control theme described above, it is often a requirement to replace wireless legacy equipment with modern, multi-functional and ideally cheaper alternatives – while keeping the historical levels of performance and security. This may involve migrating gradually over time from one to the other. This includes industrial network protocols, DECT and private two-way radio systems, and little-used wired networks in offices.

There may also be a desire in some businesses to avoid being locked-in to specific MNOs or paying per-use for connectivity that could more cost-effectively be delivered via Capex rather than Opex. Conversely, some of the emerging cloud-delivered “network as a service” models for private networks may enable a switch back to an Opex-based model with low capital outlays.

Various comparisons are often made with Wi‑Fi networks. In general, private 4G/5G requires fewer network nodes to cover an area – but devices, systems integration, and hiring appropriately-skilled people may be more costly.

Not all private cellular networks can be considered low-cost options. Some industries (such as utilities or transport hubs) may deploy “carrier-grade” or better networks, with multiple layers of redundancy and backups – for instance, the ability to support full connectivity on a site, even if one of the base stations or radio units fails.

Vertical Sectors & Use-Cases

iBwave has recently published another eBook on general 5G use cases7 which covers most of the major vertical sectors for private networks:

For most of these industries, iBwave has also published separate in-depth eBooks. For the avoidance of repetition, please see those documents for a detailed examination of the applications, device types, and deployment scenarios involved.

In addition to these, many other industries have started to use private 4G/5G networks, including smart cities and municipalities, sports and entertainment venues, finance, broadcasting, and defense/military.

While much of the historic focus around private cellular has been around industrial sites, ports/airports, or wide-area operations such as railways and utility grids, in recent years a wide variety of other sectors and locations have started to deploy private LTE or 5G capabilities.

At present, the “carpeted enterprise” sector, which forms a key part of Wi‑Fi’s marketplace, is still mostly outside private cellular reach. However, this is starting to change. Multi-dwelling units (MDUs, apartment blocks), retail sites, hospitals, hotels and shared-office spaces and others are starting to see use cases emerge, especially for outdoor areas such as car parks or campus sites.

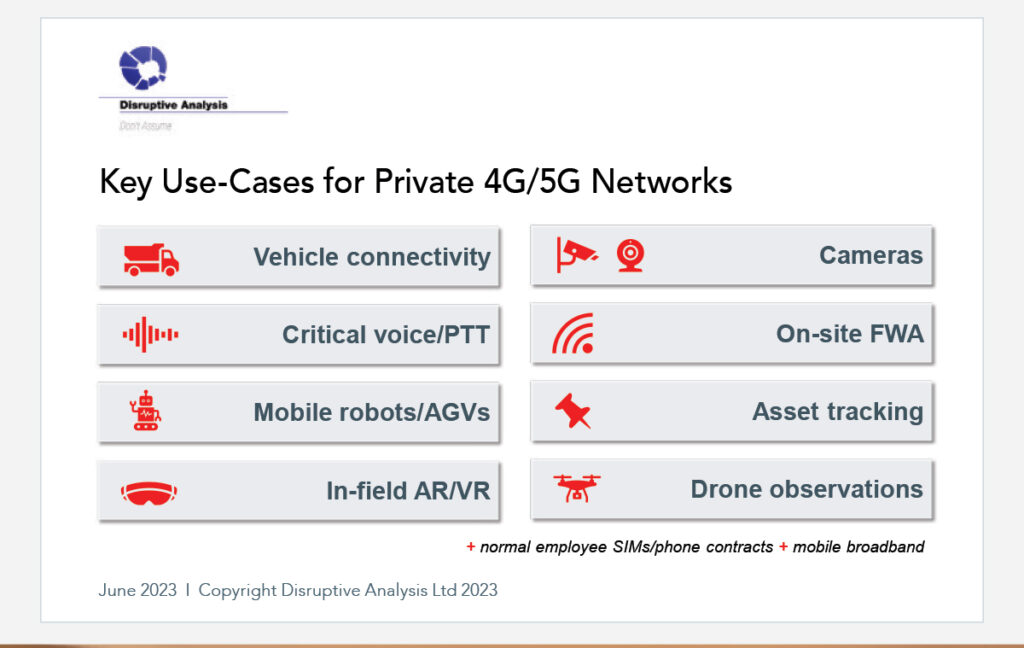

The key application and device “tenants” on a private cellular network are connections for:

Local Spectrum, CBRS & Global Differences

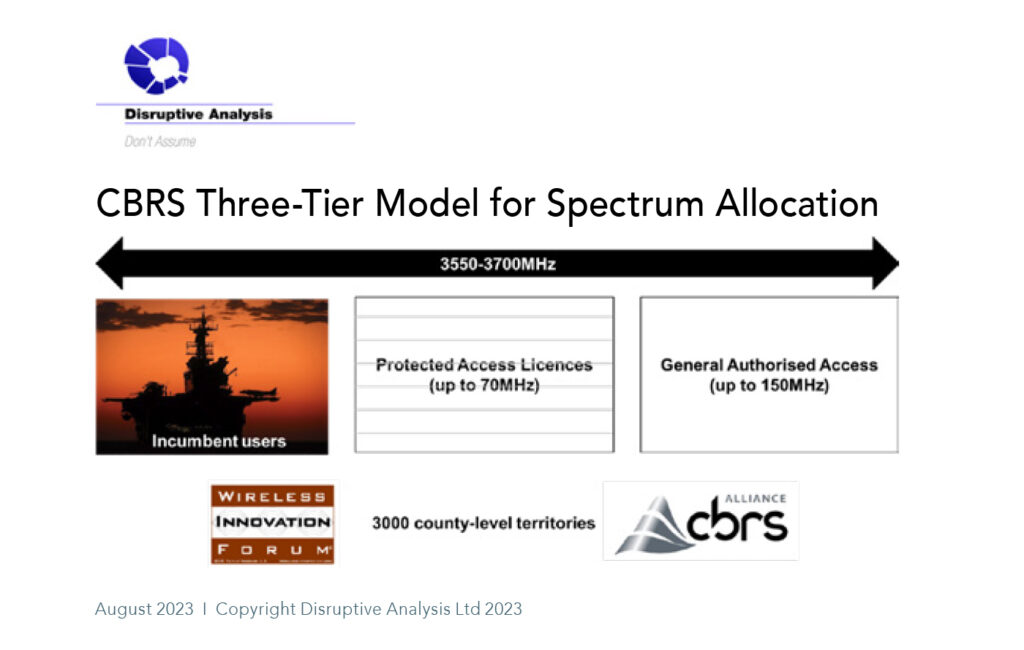

Since the previous edition of this eBook was published in 2019, the worldwide private network market has been catalyzed by the rapid commercialization of the CBRS spectrum in the US, as well as the parallel increase in the availability of suitable frequency bands in many other countries.

The associated ecosystem of vendors, systems integrators, and general awareness of the concept has grown rapidly, if unevenly. There are now over 300,000 CBRS access points (CBSDs) deployed in the US across a variety of use cases, with hundreds of local 4G/5G licenses in each of the leading markets such as Germany, the UK and Japan.

There are, however, considerable differences between the evolution of private networks around the world. These largely relate to the varied approaches to spectrum allocation for dedicated networks.

Regulators now have a growing range of options for providing spectrum suitable for private and local networks:

This means that the most important bands for private networks are now:

In addition, various other sub-GHz bands in the 700-900MHz range are sometimes leased or made available in remote areas, especially for narrowband applications such as push-to-talk voice or certain classes of IoT. Several countries have made 450MHz allocations available for sectors such as utilities.

All these frequencies and allocation mechanisms come with additional rules and obligations that are determined by the local regulators. The licenses are likely to stipulate power limits, physical siting (e.g., height above ground), mechanisms for geo-location, and duration of license validity. There may also be other non-spectrum rules for deployment, such as issuance of numbering resources, responsibilities for reporting or lawful interception, and mechanisms for dealing with any interference with neighbors.

All these licensing methods thus involve trade-offs, which then feed through to the verticals and use cases that fit best. This means that the patterns of private network adoption are likely to fragment, with some markets mostly geared towards outdoor or campus use, and others (for instance, if only mmWave bands are available) more likely to be indoors in industrial settings.

Some markets, such as the UK, have rules that favor applications such as rural FWA (fixed wireless access), and others are more oriented to industrial applications in factories and warehouses.

The US CBRS model appears to offer “something” to many groups – from extra capacity for major MNOs, to FWA, to extending campus coverage for enterprises. Nonetheless, it might fall short in delivering the 100%-reliable exclusive rights needed for the most demanding business-critical applications. However, the automation of its SAS model mean it is more agile than the manual administration of applications typical in Europe.

Some of the challenges and differences around spectrum for private 4G/5G networks include:

Disruptive Analysis believes that many of these challenges and inconsistencies will be ironed out over the next 3-4 years. There are now enough alternative approaches and successes to determine what works, and where there is friction. It seems highly likely that regulators will adapt their licensing regimes for more international harmonization of spectrum bands, and more consistency in processes.

The Role of MNOs, Telcos and Network-Slicing

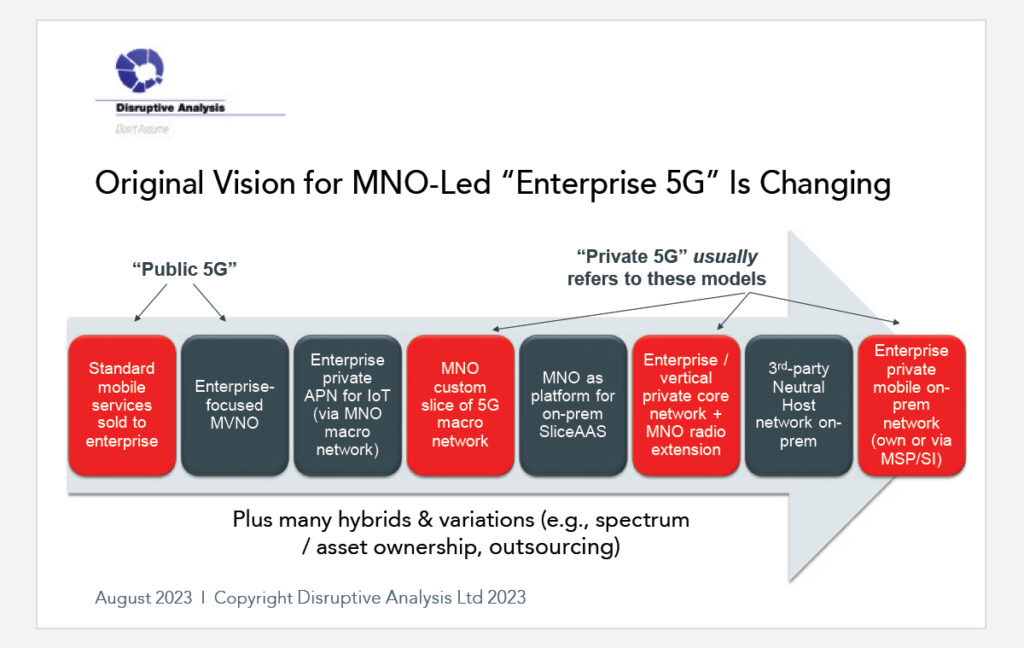

5G has often been promoted as a platform for MNOs to offer high-value connectivity services to enterprises. The initial vision often referenced IoT use cases and ultra-low latency connectivity as capabilities that could be monetized in industry verticals.

The reality has been somewhat different. Enterprises have been rather slow to adopt 5G, and in a surprising number of cases have looked for options to commission and build their own dedicated networks (often with 4G initially) rather than rely on public services from telcos.

There are several reasons for this:

In other words, the traditional mobile industry sold the vision of 5G, long before it was able to deliver it to enterprises in full. Other suppliers – and regulators offering localized spectrum – have stepped in to fill the gaps, as enterprises looked for solutions that could map to their near/medium-term needs.

However, this is now changing again. The telecoms industry has (in many cases) learned from its initial missteps and is now finding grounds for improved competitiveness in private networks. This reflects both technology evolution and business-model pragmatism.

Rather than waiting for their national networks to reach the required levels of coverage and sophistication, they are taking an “if you can’t beat them, join them” approach and offering dedicated private networks instead, sometimes with added features and a clearer roadmap towards tighter integration between public and private domains.

This approach has manifested in a number of ways:

The New Private LTE & 5G Value Chain

Today, public mobile networks have a relatively straightforward value chain. MNOs obtain spectrum and licenses from governments; network infrastructure and software from major vendors and a few specialists; use contracted engineering companies for physical deployment and maintenance; and third-party tower and property owners for cell sites.

National MNOs sell retail network and content services to consumers, and mostly standardised connections to enterprises. Some have growing IoT services businesses, perhaps with vertical specialisms in areas such as connected cars. Some have limited wholesale units that do carefully analyzed, heavily customized deals with MVNOs and MVNAs.

This value chain is now changing hugely, with the advent of private and neutral-host networks, shared/local spectrum, the integration of IoT with many complex industrial processes for which connectivity is a minor element, and the all-pervasive nature of Internet and cloud businesses.

The private 4G/5G network world is now looking much more like the IT industry today. It has heterogeneous delivery models, complex webs of strategic and tactical partnerships, “co-opetition”, integrators, consultants and sub-contractors, OEM and white-label business models, cloud-delivered “as a service” propositions and a far broader array of services providers willing to move from adjacent domains into building/running private or shared networks.

In particular, there is much more involvement from enterprise IT systems integrators (for instance, Cap Gemini and Kyndryl), industrial systems (often “operational technology”) vendors such as Siemens and Airbus, specialists in critical-communications systems, Internet/cloud players (notably Amazon AWS and Microsoft Azure), wireless towercos, and even property developers looking at the value derived from better connectivity in their buildings.

We are also seeing a new breed of “Industrial Mobile Operators” and managed service providers, often arms of diversified “infracos” such as Cellnex, Boldyn (formerly BAI) and Digital Bridge. Another unanticipated branch of the value-web is that of fixed-line enterprise SPs, such as Verizon Business in Europe, or Tata Communications.

Over the last few years, there has also been a growing role for governmental bodies. As discussed elsewhere, this ranges from local authorities and municipalities using private networks for smart city functions such as traffic control, through to military organizations such as NATO looking at private 5G for a variety of use cases.

Increasingly, sectors with existing specialized network expertise, such as defense, broadcast, industrial systems and aviation, are bridging the gulf between 4G/5G customer and service provider.

New Roles in the New Private LTE & 5G Value-Chain

| Stakeholder group | Roles in national MNO era | Additional roles in private 4G/5G era | |

|---|---|---|---|

| MNOs | Spectrum ownership, network deployment & operation, consumer & B2B mass-market services | Local breakout, system integration, network slices, vertical units, spectrum leasing, government projects | |

| Enterprises | Customers of B2B MNO services, use of private onsite networks (Wi‑Fi, proprietary, cellular DAS) | Local & some wide-area spectrum, private RANs & core networks, policy & regulatory, network-as-product | |

| TowerCo’s | Ownership of shared radio-network assets | Private networks units, indoor systems, neutral host, collaboration with municipalities, rail & road networks | |

| Major vendors | Provision of large-scale radio, core & transport networks, BSS/OSS and integration/operation | ➡️ | Dedicated network solutions, integration & management for verticals. Extensive partner integrator reach |

| Small vendors | Small cells, niche core networks, indoor systems, planning & design tools, optical/backhaul, NFV | ➡️ | Optimized products for private use, e.g. easy deploy, cloud platforms, design & test tools, sales through MNOs. |

| Fixed / cable SPs | Backhaul & transport, some MVNO services | ➡️ | Private 4G/5G provision, neutral host, vertical solutions |

| Cloud / Internet providers | Limited role in cell network provision historically | ➡️ | Private network-aaS. Hosting cloud-based 5G cores. Edge computing. IoT & AI solutions. Open RAN |

| IoT / OT / industrial automation system vendors | Limited role in cell network provision historically | ➡️ | Industrial/process systems with integral 4G/5G. Major automation & Industry 4.0 projects. Driving standards |

| Venue / property co’s | Provision of indoor coverage systems & installation of MNOs’ signal-sources/cells for DAS | ➡️ | Local spectrum & neutral host network projects, smart buildings & IoT, work with new classes of SP |

| Critical comms suppliers | Dedicated PMR/TETRA/P25 systems for industrial, transport & public safety users | ➡️ | 4G & 5G critical comms for verticals & public safety. Legacy system integration & migration |

| IT systems integrators | Limited role in cell network provision historically | ➡️ | Advisory work on connected verticals, private 5G, cloud + edge + AI solutions etc |

| Wi‑Fi vendors & SPs | Some offload & converged network deployments | Some shift to local cellular eg CBRS + WiFi hybrids. M&A eg (HPE Aruba + Athonet). | |

| Govts & municipalities | Regulation, sites, some private cellular networks | Private networks for public safety, own networks for smart cities/regions, roads, rail, neutral hosts | |

Conclusions and Predictions

The market for private cellular networks is rapidly maturing. As recently as five years ago, it was based around niches, especially sectors like mining, oil, military and public-safety – mostly for uses such as push-to-talk voice.

Now, private 4G/5G is becoming commonplace in ports, airports, warehouses, manufacturing sites, sports/entertainment, and other verticals. Early deployments are being seen in offices, retail, and hospitality.

There is little deployment in normal offices, hotels, retail facilities, or entertainment/sports venues – even though the concept has been discussed for about 20 years.

More importantly, the use cases and applications have evolved rapidly as well. There is widespread use for connecting cameras, whether for security or production automation and AI. Vehicles, both human-driven and autonomous, are popular use cases, especially because the incremental cost of a 4G/5G radio is small compared with a complex machine which may cost many hundred thousands or even millions of dollars.

Ongoing shifts in spectrum policy and ecosystems of vendors/integrators have proven to be game changers. Many countries have watched US CBRS deployments and parallel early trends in Germany, UK and Japan. There is a wide range of suppliers and growing awareness among enterprises (and governments) of the benefits and possibilities, although the traditional MNO sector still pushes back against spectrum allocations, instead arguing for approaches that favor its own solutions and services.

That said, there is also a measure of hype and fragmentation. Some of the forecasts appear to have been over-enthusiastic and underestimated the time to develop tools such as design/test products, develop skills – and also go through lengthy trials and proofs-of-concept in industries that can be quite conservative.

Disruptive Analysis thinks that the jury is still out on exactly how far and fast the sector will change, but there are some plausible mid-term scenarios in which the number of private networks rises to tens of thousands, perhaps hundreds of thousands. (As a historical note, in 2019 when this eBook was first published, the same sentence had one fewer zero). Further acceleration is possible if the fully-automated “network as a service” vision promoted by players such as Amazon AWS prove successful.

To put this into perspective, there are about a million existing commercial buildings worldwide with indoor cellular-coverage systems, and probably 10 million or more with professional Wi‑Fi installations (although some, such as retail stores, may just have a single access point).

This is going to continue to be one of the most dynamic – yet unpredictable – wireless sectors for the next few years. Agility will be essential, as will human skills, enabling tools, and a willingness to partner across the value chain.

By the time 6G appears in 2030, we can expect private networks to be “first-class citizens” in the mobile world. The early discussions by ITU (the International Telecoms Union) defining the requirements and expectations already highlight the importance of verticals and enterprise upfront, which is an incredibly positive sign for the future.

About iBwave

iBwave Solutions, the standard for converged indoor network planning, is the power behind great in-building wireless experience, enabling billions of end users and devices to connect inside a wide range of venues. As the global industry reference, our software solutions allow for smarter planning, design, and deployment of any project regardless of size, complexity, or technology. Along with innovative software, we are recognized for world-class support in 100 countries, as the industry’s most comprehensive components database and as a well-established certification program. For more information, please contact us.